USD falls on the back of China threat to curtail US debt buying

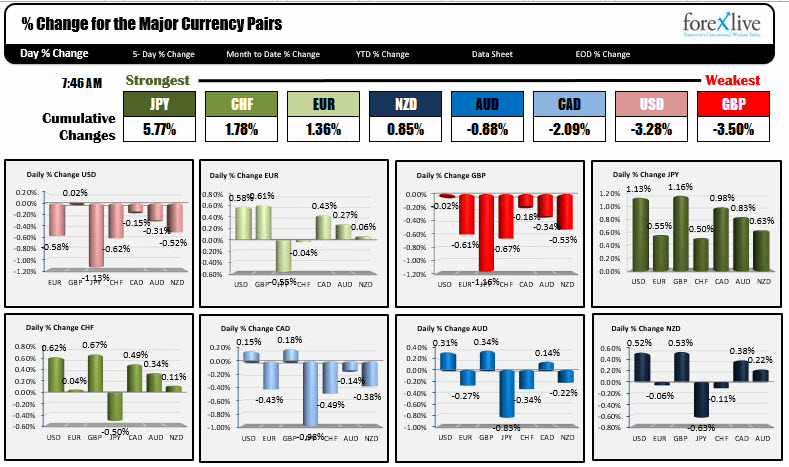

The JPY rose yesterday after the BOJ trimmed bond purchases. That trend continued today making the JPY the strongest currency of the day. That weakness has been helped by a generally weaker dollar on the back of headline news that China might look to curtail its buying of US debt. China, of course, is a big buyer of US debt. As a result, the USD is running neck in neck with the GBP for the weakest currency of the day today.

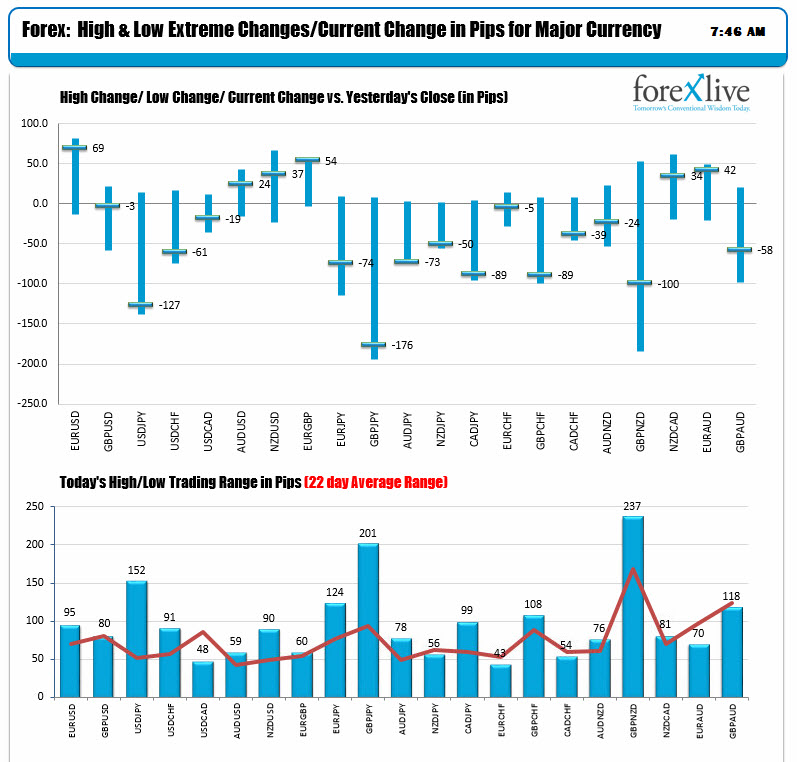

The price action is pretty good today as a result of the news with most of the major currencies and crosses at or above the 22 day average trading ranges (red line in the lower chart below). JPY pairs are trading near low levels and barely made it to positive territory. Trends are on.

In other markets, a snapshot shows:

- Spot gold is benefiting from the turmoil with the price up about $10 or 0.75% at $1322.72

- WTI crude oil futures continue to run higher they are up $.59 or 0.94% at $63.55

- US yields are higher: the 2-year is at 1.964%, unchanged. 5-year 2.3443, up 1.4 basis points. 10 year 2.586%, up 3.3 basis points. 30-year 2.9346%, up 4.0 basis points.

- US stocks in premarket trading or lower. S&P futures are down -11.5 points. Dow futures are down -115 points. NASDAQ futures are down -40.75 points. A decline today would break the string of record closes since the first trading day year.

- CME bitcoin is down -5.83%. Ripple, which has been a lagging crypto play, is down -13.17%.

- A European equity markets stocks are mostly lower. Germany's DAX -0.9%. France's CAC -0.4%. UK's FTSE unchanged. Spain's Ibex unchanged. Italy's FTSE MIB is up 0.2%.

- 10-year yields in Europe are mixed. Germany 0.536%, up 7 basis points. France 0.81%, down -1.0 basis points. UK 1.286%, unchanged. Spain 1.53%, up 1.5 basis points. Italy 2.035%, unchanged. Portugal 1.863% unchanged