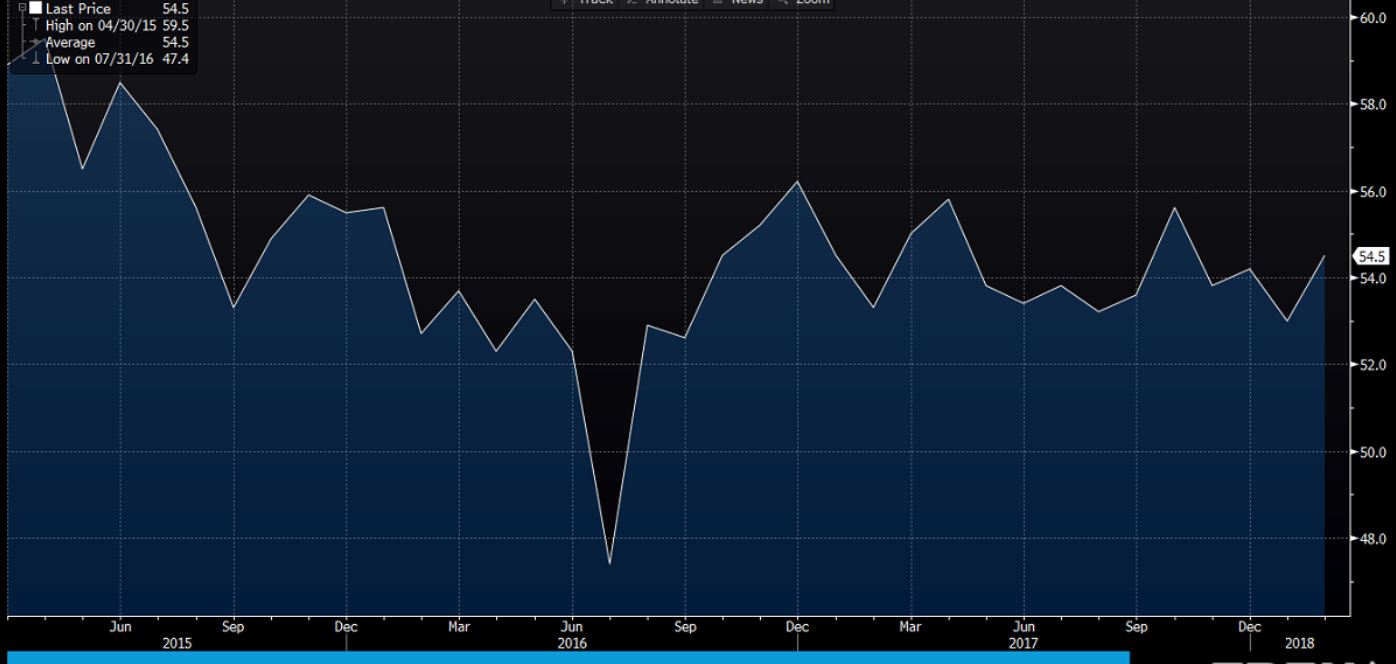

UK Markit/CIPS Feb services PMI data now out 5 March

- 53.0 prev

- composite 54.5 vs 53.6 exp vs 53.5 prev

Better than expected reading sees GBPUSD back up to 1.3802 from 1.3785 prior. EURGBP still underpinned but a tad lower at 0.8926. GBPJPY 145.62 from 145.50

Looks like this move will be faded given the GBP supply prior and option expiries today at 1.3830 but going nowhere in a hurry and a good report overall so dip demand expected too.

Say Markit:

- UK service providers experienced a modest rebound in business activity growth during February, supported by the fastest rise in new work since May 2017. The latest survey also pointed to stronger job creation across the service economy, with payroll numbers rising to the greatest extent for five months as firms sought to boost operating capacity in response to improved order books.

- At the same time, cost pressures moderated to their lowest for a year-and-a-half, which contributed to a further slowdown in prices charged inflation.

Chief economist Chris Williamson says;

"Selling price inflation cooled to a six-month low, adding further evidence to suggest that price pressures peaked late last year, but remain stubbornly elevated. The surveys brought further signs that shortages, notably of materials and labour are pushing up prices.

"With Bank of England policymakers sounding hawkish even following the January fall in the PMI to a one-and-a-half year low, the February upturn in the surveys surely leaves a May rate hike very much in play. The Bank seems keen to normalise interest rates even if output growth is below levels it would usually like to see when tightening policy"

Full report here