Commonwealth Bank Manufacturing PMI Purchasing Managers' Index Report

Manufacturing and Services both released today. This is the first release of this new data indicator. A third, the 'Composite' is also summarised.

--

Manufacturing:

June 56.2

- May 55.9

'Key findings':

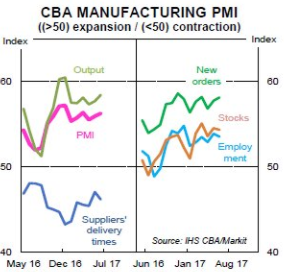

Growth of Australia's manufacturing sector was sustained at a marked pace in June, underpinned by faster gains in both output and new orders.

- Demand and market activity were both reported to have strengthened since May, and this placed further pressure on manufacturers' capacity.

- With manufacturers confident that growth will be sustained, employment, purchasing activity and stock building were all subsequently increased.

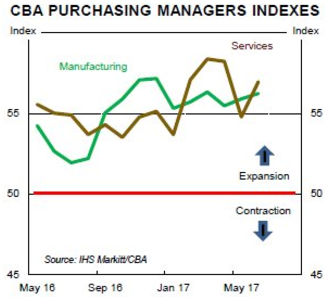

The headline index from the survey, the seasonally adjusted Commonwealth Bank Manufacturing Purchasing Managers' IndexTM (PMI®) - a composite indicator designed to measure the performance of the manufacturing economy - recorded 56.2 in June.

- Rising from 55.9 in the preceding month, the latest index reading pointed to the sharpest improvement in manufacturing sector operating conditions since March.

- Readings above 50.0 signal growth, while those below 50.0 indicate contraction. The index has signalled continuous expansion throughout the fourteen months that data have been collected.

Commenting on the Commonwealth Bank Manufacturing PMI data, Michael Blythe, Chief Economist at the Commonwealth Bank, said:

- "The strongly positive PMI readings are an encouraging sign of underlying momentum in the Australian economy after the disappointing Q1 GDP growth numbers".

- "The pressure on capacity evident in the survey responses is a positive indication for further jobs growth and brings us a step closer to the long-awaited lift in business capex. It may also signal an incipient turn in what has been a very benign inflation backdrop in recent years"

--

For the Services PMI: June 57.0

- May 54.8

'Key findings':

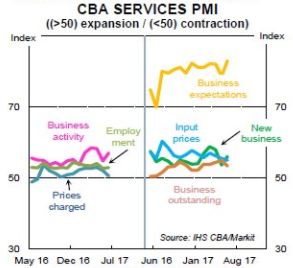

- Australia's service sector remained comfortably inside expansionary territory during June. Both activity and new business rose at stronger rates, whilst increased workloads encouraged companies to take on additional staff.

- Although input costs continued to rise, inflation was the lowest in 14 months, and companies raised their own charges marginally. Buoyed by trends in demand, optimism regarding the future hit a new survey high.

Commenting on the Commonwealth Bank Services and Composite PMI data, Michael Blythe, Chief Economist at the Commonwealth Bank:

- "Much of the recent growth in the Australian economy reflects a buoyant services sector. The ongoing positive Services PMI readings tells us that the services sector will remain a key driver. Together with strongly positive readings from the Manufacturing PMI, the Australian economy appears to be in respectable shape as at midyear"

- "Some service providers noted skill shortages and increased demand for labour were impacting on wages growth. A pick up in wages growth from current very low rates would help the key consumer part of the Australian economy. These pressures are yet to show in output prices. But it adds to other signals warning that our very benign inflation backdrop will not continue indefinitely."

--

Commonwealth Bank Composite PMI

June 57.2

- prior 55.2

The Commonwealth Bank Composite Output Index is a GDP-weighted average of the Commonwealth Bank Manufacturing Output Index and the Commonwealth Bank Services Business Activity Index. It is designed to provide a timely indication of changes in business activity in the Australian private sector economy as a whole. Readings above 50.0 signal an improvement in business activity on the previous month while readings below 50.0 show deterioration.

The manufacturing and service sectors both recorded stronger growth in activity during the month, in both instances driven higher by increased levels of incoming new work.

Commenting on the Commonwealth Bank Services and Composite PMI data, Michael Blythe, Chief Economist at the Commonwealth Bank, said:

- "Much of the recent growth in the Australian economy reflects a buoyant services sector. The ongoing positive Services PMI readings tells us that the services sector will remain a key driver. Together with strongly positive readings from the Manufacturing PMI, the Australian economy appears to be in respectable shape as at midyear". Mr Blythe added: "Some service providers noted skill shortages and increased demand for labour were impacting on wages growth. A pick up in wages growth from current very low rates would help the key consumer part of the Australian economy. These pressures are yet to show in output prices. But it adds to other signals warning that our very benign inflation backdrop will not continue indefinitely."

--

I've included a lot of detail this month as it's the first ever release ... the post on this won't be so detailed in coming months but I hope this is helpful today.