The battle is on...

As Adam posted, there was a report that there would be no exemptions on the steel and aluminum tariffs last week.

As we know, EU's Juncker also responded last week by saying the EU "could not simply put their head in the sand" and proposed a tariff on bourbon, bikes (as in Harley Davidson motorcycles) and blue jeans (the Three B's).

Meanwhile, over in Canada, Justin Trudeau said any tariffs on steel and aluminum would be "absolutely unacceptable".

China said tariffs would have a "huge impact" on the global trading order. They added that they would work with other nations to protect their interests.

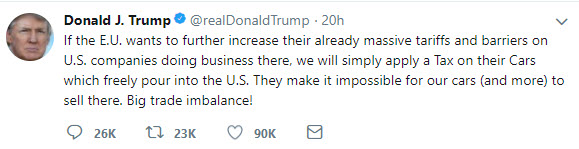

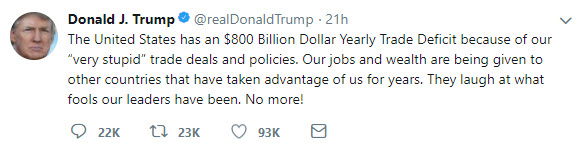

Trump's tweets did not back down, and with his trade guns blazing, he shot back over the weekend with:

And perhaps a NAFTA shot when he said:

Bang. Bang. Bang.

Meanwhile, Commerce Secretary Wilbur Ross said that tariff on steel would amount to $9B and would represent a fraction of 1% of the overall US economy. He added, "So the notion that it would destroy a lot of jobs, raise prices, disrupt things, is wrong,"

Ross added, the EU proposed tariff would represent $3B of goods exported and that was a "tiny, tiny fraction of 1%". Again, that is nothing to worry about...

Yet the market is worried (and will continue to be worried)

The focus a week ago was on guns in the US. That was not a good thing for Trump's base.

This week, different shots are being fired on the trade front (which is good for his standing with his base). It may be justified from a perspective (the US runs a large trade deficit, goods from China are being dumped in the US from other countries), but you wonder if there is a better way than taking out the "trade gun" and firing away with tariffs.

You also wonder if steps forward made on things like NAFTA negotiations, are now taking a big step back, because steel producers jobs have been eliminated.

There was a segment on CNBC from a steel or aluminum producer last week. A reporter was sent to the plant to do a story. The funny thing about it, was the shots of the plant floor showed very few people. The stuff going on was largely automated. The talk was that the tariff would allow for the "idle plant" to be brought back online and that would create more jobs.

I wonder if that is the case, how many jobs will be created. Is it the same amount, that have been lost from 2 years ago, 5 years ago 10 years ago? Probably not.

I gotta think that the US steel and aluminum producers have not sat idling. That they have been adjusting. They have become more efficient. Maybe for some, they have had to idle operations because of global oversupply, or lack of efficiency. A steel mill is not the same today as it was 5 years ago or 10 years ago.

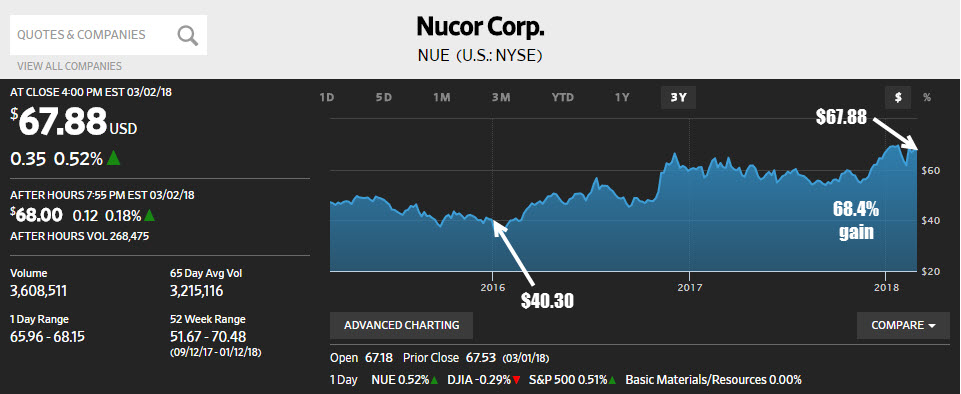

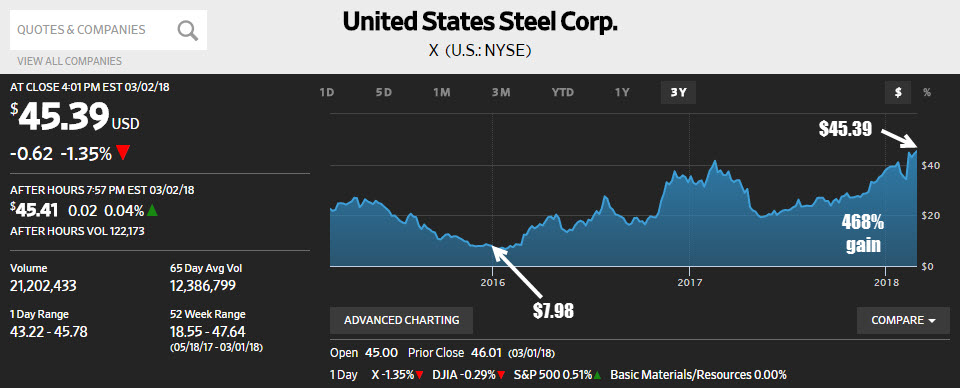

The stock price should reflect the success or failure in their business.

I am not an expert on steel, but Nucor was one of the prominent names from last week's meetings and news.

If you go back over the last couple of years, Nucors stock at the end of 2015 was trading at $40.30. The close on Friday was up to $67.88. That is a gain of 68.4%.

If you look at US Steel at the end of 2015, the stock was at $7.98. It is now at $45.39. That is a 468% gain.

Apple has done pretty well too over the last couple of years. It's gain? The stock moved from $105.26 to $176.21 or 67.6% - just below the return from Nucor.

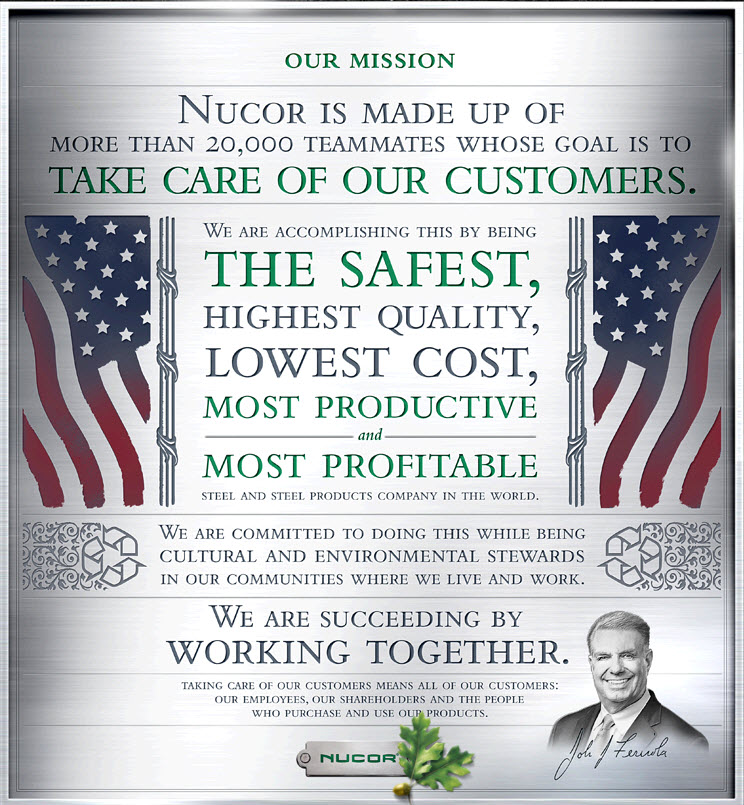

Now if you go back further. the comparisons are not as favorable of course. They had to adjust to the environment. In fact here is the mission from Nucor:

I like that. I like it a lot.

How do they do that? My guess it is a lot has to do with modernizing, engineering, looking at ways to do things better and cheaper. That works its way to profitability in a repetitive industry like steel production, and allows them to compete even when the hand is stacked against them.

I looked at the jobs available at Nucor and although there are a smattering of the plant floor type jobs, the majority are for engineers, sales, accountants, software developers, and other non-floor roles.

Now I don't know what the mix of "plant" vs "non-plant" jobs are in total, but to compete in a market dominated by dumping from overseas and have your stock go up at Apple trajectory and well beyond, they are doing something right now. Hats off to them and their plans.

So....the shots are being shot, and maybe there are trade imbalances. Fix the unfair at the source, show why, and then beat them by making steel cheaper, but understand, the jobs of yesterday, are not necessarily the jobs of today.

I wish I had had a little Nucor and US Steel a few years ago. Who needs tech in technology firms, when you can have tech in big industry, providing a run.