Earlier post on the Reserve Bank of Australia March meeting minutes is here:

Some (in brief) commentary from CBA:

- no surprises

- key themes of a strong global back drop, solid domestic economic conditions but weak wages growth and inflation growth have not changed

- growth is expected to exceed potential in 2018. With potential growth considered to be in the order of 2.75% it looks as if the 3% growth forecasts is still in place

The underlying message is that global and domestic economic conditions are good. But domestic wages and inflation are still weak. Which means that rate hikes are still some way off.

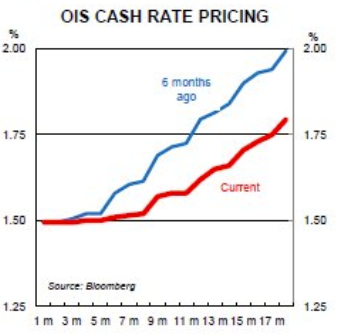

Our central forecast is for a November rate hike, although the risk lies with a later start to the tightening cycle. Market pricing has also shifted in recent months with a rate hike now not fully priced in until around mid-2019.

(bolding mine)