Bill Gross sounds alarms

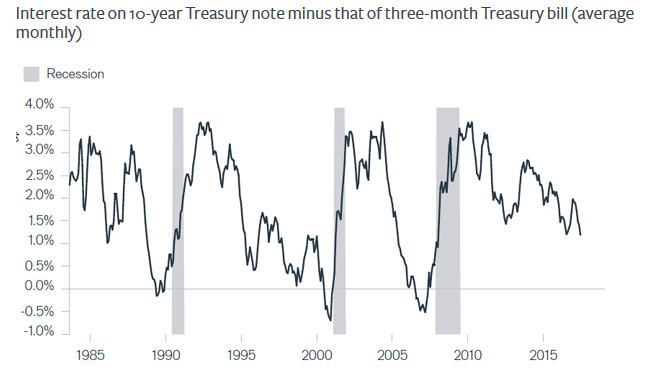

The yield curve is the ultimate signal and an inverted yield curve is the ultimate recessionary signal.

At the same time, the Fed has been actively trying to skew the bond market through its QE programs. So maybe those signals aren't as clear as they used to be.

Bill Gross argues that the spread between T-Bills and the 10-year yield doesn't need to go sub-zero to indicate a recession is coming.

"Since the current spread of 80 basis points is far from the "triggering" spread of 0, economists and some Fed officials as well, believe a recession can be nowhere in sight," he writes in his latest Investment Outlook. "Perhaps. But the reliance on historical models in an era of extraordinary monetary policy should suggest caution."

Gross argues that the front end is the most important and that rates rising 85 bps is small in magnitude but it's also a doubling of the rates people are paying. Because of that, he argues that it's more dangers.

"Today's highly levered domestic and global economies which have "feasted" on the easy monetary policies of recent years can likely not stand anywhere close to the flat yield curves witnessed in prior decades. Central bankers and indeed investors should view additional tightening and "normalizing" of short term rates with caution," he writes.