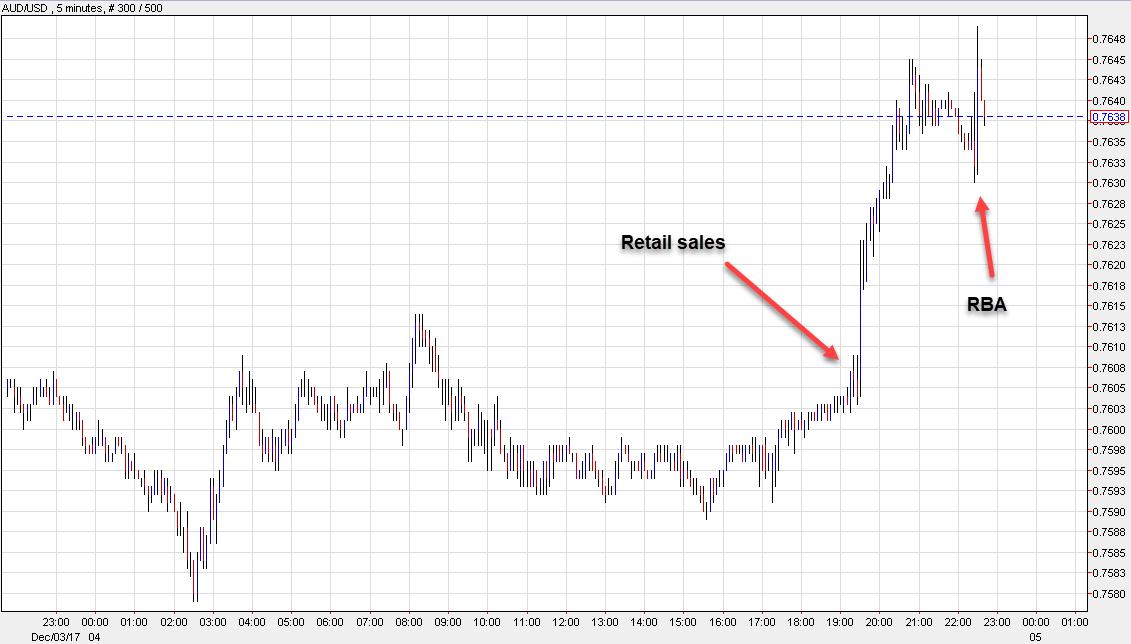

AUD/USD touches session high after central bank decision

The Australian dollar is slightly higher after the Reserve Bank of Australia opted to leave interest rates at 1.50%. The main story is that the statement shifted its tone on inflation.

The previous statement said: "In underlying terms, inflation is likely to remain low for some time, reflecting the slow growth in labour costs and increased competitive pressures, especially in retailing." That line was omitted from the latest statement in a subtle hint that policymakers see prices creeping higher.

This was the 15th consecutive meeting where the RBA has stood pat and the market continues to expect a long period of flat rates. Looking out to April, there is an 11% chance of a hike priced in. That rises to 36% by June 2018 and 52% by September of next year.

The complacency is reflected in the Australian dollar, which traded in a sub-20 pip range after the decision. The RBA doesn't meet in December so it will be two months before they have a chance to send a fresh signal on rates. By that time, the idea of global synchronized growth will have gained momentum or will have hit a setback.

The bigger move today came after a stronger retail sales report.