Keeping an eye on the options as we head into March

I've been keeping half an eye on the USDJPY option expiries and the expiries are building up. For a comparison, here's a 3 week snapshot from Jan 18th vs a 3 week look from today;

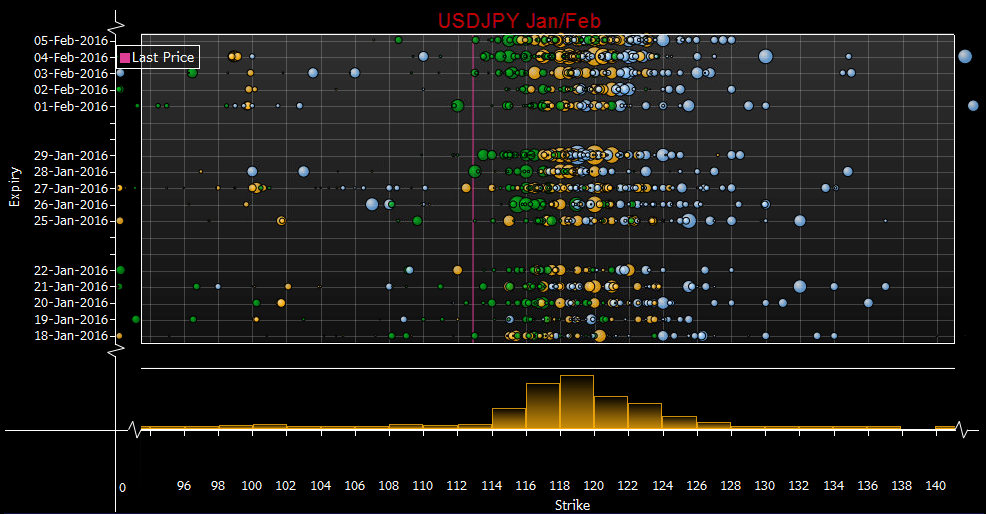

USDJPY expiries 3 week period Jan/Feb

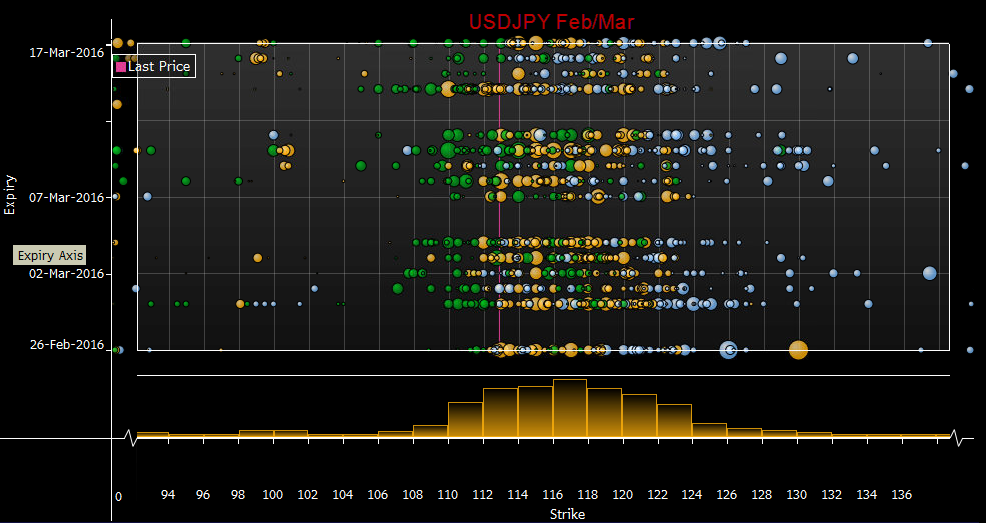

USDJPY expiries 3 weeks Feb/Mar

As you can see there's far more and a spread over a wider range now than the Jan/Feb period.

Firstly, don't bother asking. I'm not going to note every bubble's size and strike. You have to hover the mouse arrow over each one to get the details to pop up. The bubbles are individual strike prices that can contain many option trades, not just one.

Secondly, this picture can and will change daily so it could be completely different Monday and in 2 weeks time. I'm just keeping watch to see if we get anything really lumpy. The expiries that Mike posts will still give us the day to day numbers.

I wrote about the possible effect to FX from the Japanese FY end here. This goes to show that we'll have some increased activity in yen pairs over the next 3/4 weeks. Flows into the yen haven't been as strong over the last few years but that doesn't mean to say it won't have an impact this year. There's nothing much to grasp to trade on with this info but it may help us manage our risk better if we get a clue that the yen could see some strong demand.