Yellen statement before the Q&A

- Our cautious approach to policy has been appropriate

- Some factors weighing on weak growth were anticipated (cites trade and oil)

- Slowdown in some parts of the economy, particularly weak business investment was a surprise

- Weak consumer spending was also a negative surprise

- Q1 slowdown in consumer spending appears to be temporary

- Pace of labor improvement has slowed markedly

- Some signs that wage growth may finally be picking up

- Important not to overreact to 1-2 weak jobs reports, we will be watching carefully

- Much of the shortfall in inflation continues to reflect energy and imports

- Core inflation 'close' to 1.5%, expects it will rise to 2% over next 2-3 years

That's a long timeline. The kind of timeline that argues for lower rates and a lower dollar

- Can't take long run inflation expectations for granted

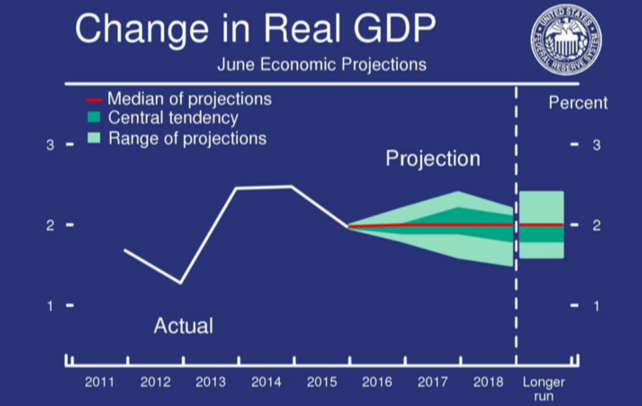

- Median growth expectations slightly lower

- Unchanged rate reflects FOMC's careful approach, particularly in light of mixed readings on jobs and elsewhere

- Caution all-the-more appropriate give low rates

- Vulnerabilities in global economy remain

- Calls global growth 'sluggish'

- Investor perceptions for risk can change abruptly

- FOMC forecasts aren't a fixed plan for policy