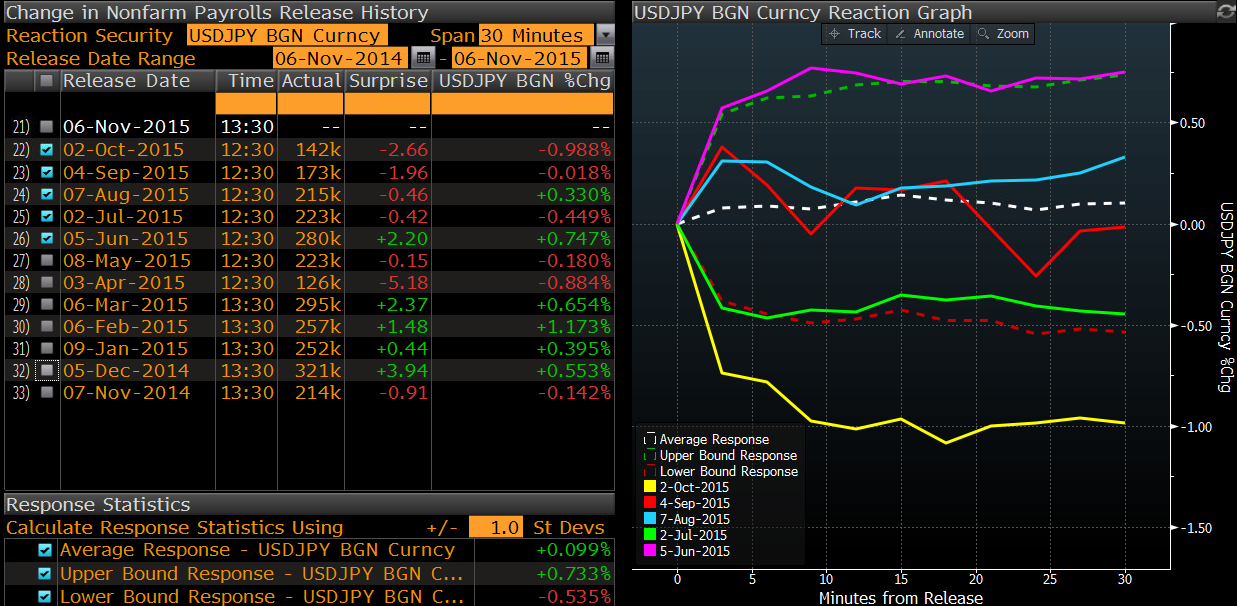

September's big miss in payrolls gave us the biggest 30 minute price move since the Jan report in early Feb

That report saw payrolls 27k above the 230k expected but the 77k higher revision to Dec's 252k added a lot to the moves. That day we saw the change in USDJPY over 30 minutes at 1.173%. Last months report saw a change of -0.988%, well below the lower expected bound

NFP impact on USDJPY over 30 minutes

We can see what that meant to USDJPY that day

USDJPY 30m chart

Once again though, the buyers were waiting in the wings and we ran all the way back up

In a weird coincidence, we were trading around the same levels we are today in cable the day of the release and saw a near 100 pip spike to just under 1.5240. 1.5135/40 was support into the figure and was confirmed as a double bottom the next week. Spooky eh?

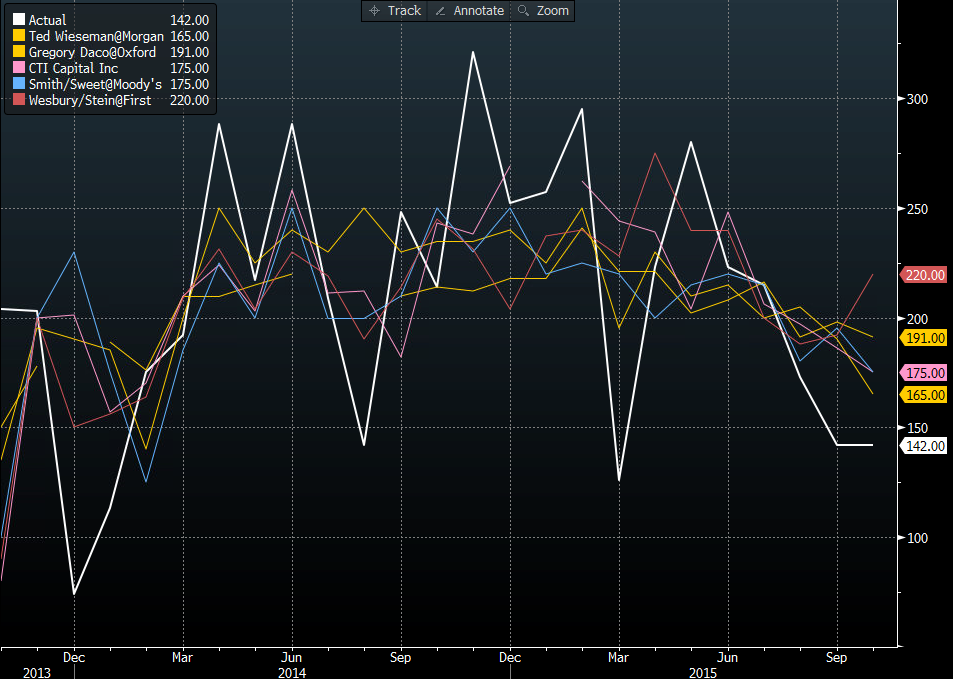

Greg has done a fine job in giving us the numbers that matter in his non-farm preview so lets have a look at what the top NFP pickers are going for today

The top 5 (and their guesses) is as follows;

- Ted Wiesman - Morgan Stanley 165k

- Wesbury/Stein - First Trust advisors 220k

- CTI Capital Inc 175k

- Gregory Daco - Oxford Economics USA 191k

- Smith/Sweet - Moody's 175k

NFP pickers results

Today's estimates are around the 180k mark but I think that we see a lower number based on the fact that we haven't seen much, if any improvement in most of the data points. I've gone for 118k as my choice and if you haven't already, you can make your choice and be in with a chance to win a copy of Greg's ACT book. Click on the link below and place your guesses in the comments on that post only (not this one, or it won't count)

Do you want to know what the Non-farm payrolls number will be this Friday?

Best of luck to you all those trading over/though it