Canadian unemployment is listed at 6.9% while in the US it’s 7.3% but that vastly understates the differences in the health of the relative jobs markets.

First of all, if you go back to pre-crisis times, Canadian employment was around 6% which is something akin to full employment by Canadian standards. Before the crisis in the US, unemployment was at 4.5%. Differences in how the countries measure unemployment, helps to explain the gap.

Skipping ahead to the present, Canada is now 0.9 percentage points away from pre-crisis unemployment levels while the US is 2.6 percentage points off.

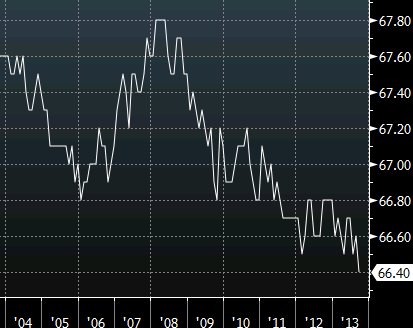

Alone that’s an interesting story but it’s not even the kicker. The real story is in the participation rate. In Canada, the pre-crisis average was around 67.4% while in the US it was about 66.1%. Today, the Canadian participation rates has fallen by 1 percentage point while in the US it’s down 2.9 percentage points.

Canadian participation rate chart 10 years

It’s been a much steeper fall in the US.

US participation rate chart 10 years

The nail in the coffin is demographics.

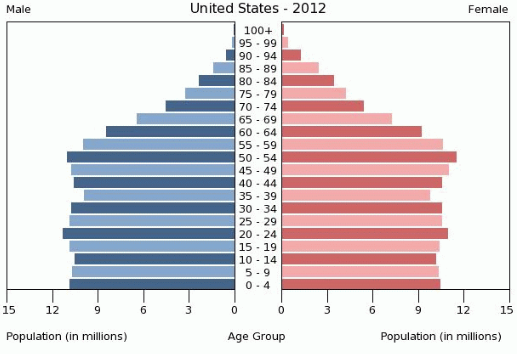

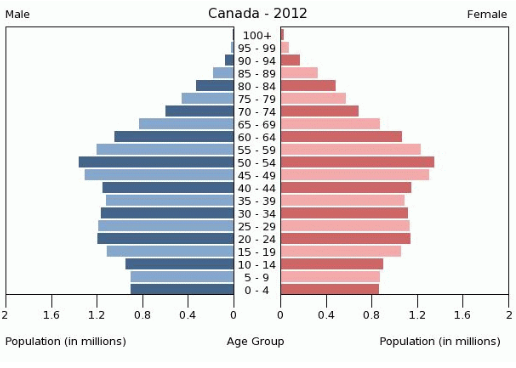

The Fed has repeatedly pointed to demographics (ie older people retiring) as the reason for US workers exiting the workforce but US and Canadian demographics are very similar. What’s more is that based on demographics you would expect more Canadian workers to be leaving the workforce than the US.

The marginal worker leaving the workforce is 55-65 years old. In the US, the 55-59 year-old cohort is around 10% of the population; in Canada it’s 12%. In the US, 60-64 year olds are 9% of the total while they’re 10% in Canada.

US population pyramid

Canadian population pyramid

What does it mean?

A conservative (albeit simplistic) estimate would put Canadian unemployment around 3.8 percentage points healthier than the United States, far more than the 0.4 percentage point difference in official rates.

More importantly for traders, it shows that the Fed is vastly overestimating the health of the US labor market. It suggests that far more workers are leaving the US jobs market for reasons other than retirement/demographics — they’re likely discouraged workers.

What’s more, despite the large differences in employment, Canada doesn’t have any signs of inflation. The Fed may (and probably should) taper due to the financial risks of holding a $3.6 trillion balance sheet but any argument about tapering due to improved employment or inflation risks is a canard.