The latest client note from CIBC courtesy of our good friends at efxnews.com

CIBC write that traders of the loonie <rather than loony traders> should be cautious punting on Canadian $ appreciation

Say CIBC's Andrew Grantham and Avery Shenfield:

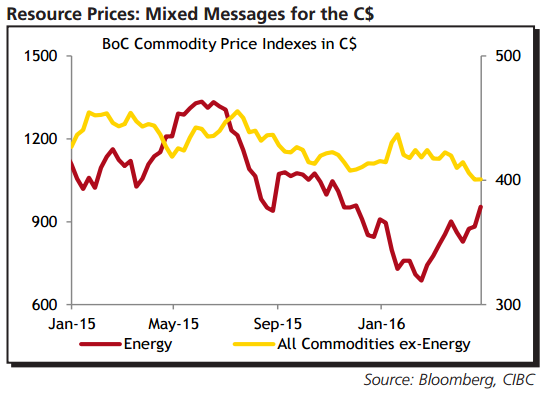

Crude catches all the headlines, but Canada isn't Saudi Arabia. Beyond oil, Canadian exports have a significant weighting in natural gas, which in C$ terms has been weakening rather than improving.

While the overall energy basket is still rebounding in C$ terms, ex-energy commodities have seen further declines, with weakness in potash, for example, and prices for foods and metals too flat in US$ terms to offset the loonie's appreciation.

Similarly, for non-resource firms, the appreciation of the C$ will be cutting into their export revenues in domestic currency terms.

Add it all up, and the pricing picture for exporters isn't improving nearly as much as oil alone would indicate, a reason to be cautious in betting on further C$ appreciation at these levels.

USDCAD currently 1.2527 with Brent $47.21 and WTI $45.94 both on the rebound from earlier session lows