Australian dollar shorts give way

It was nearly a perfect day for Australian dollar shorts. The Q3 Australian CPI report was much softer than expected and it was followed up with a hawkish Fed statement.

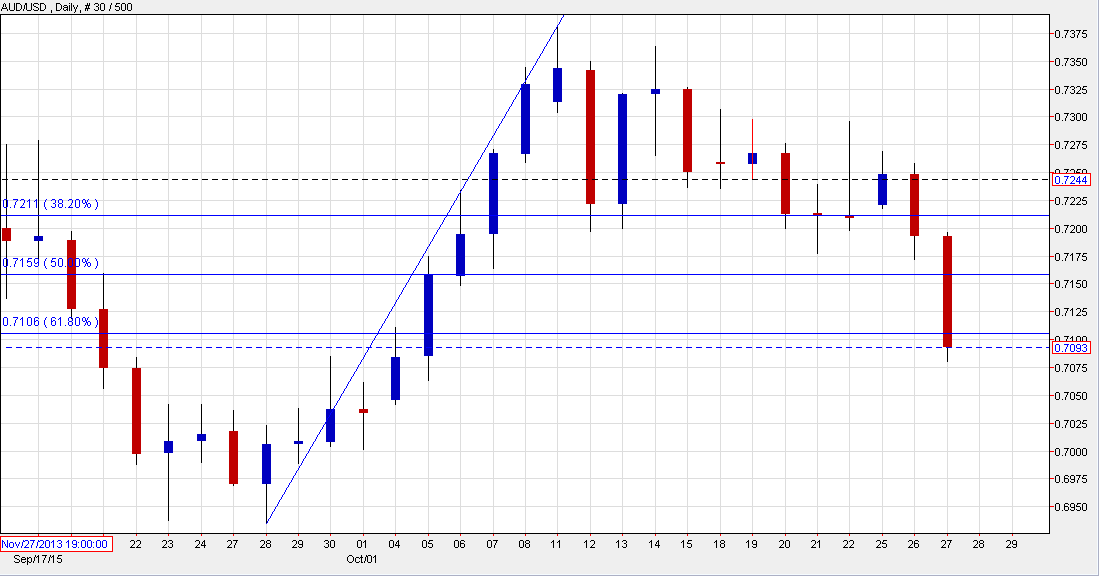

It's no surprise AUD/USD is down 106 pips to 0.7088 and it would be more if commodities weren't so buoyant.

I suspect the selling will hit in the coming days as worries about an RBA cut mount. Stevens is one of the most unpredictable central bankers and the CPI report along with bank hiking mortgage rates will rekindle talk of a move next week.

Technically, the 61.8% retracement of the October rally has now given way and that points to a return to the late September low.

Another factor is that Chinese stocks have begun to look sluggish once again. The Shanghai Composite is now below when the PBOC delivered a surprise rate cut, indicating that the worries are ramping back up.

Finally, the AUD/USD positive seasonals that were a tailwind in October have now come to an end.

Before jumping in, keep an eye out for the RBNZ decision in a few hours for a preview of what the RBA may have to say.