9 straight days of gains go pop in the aussie

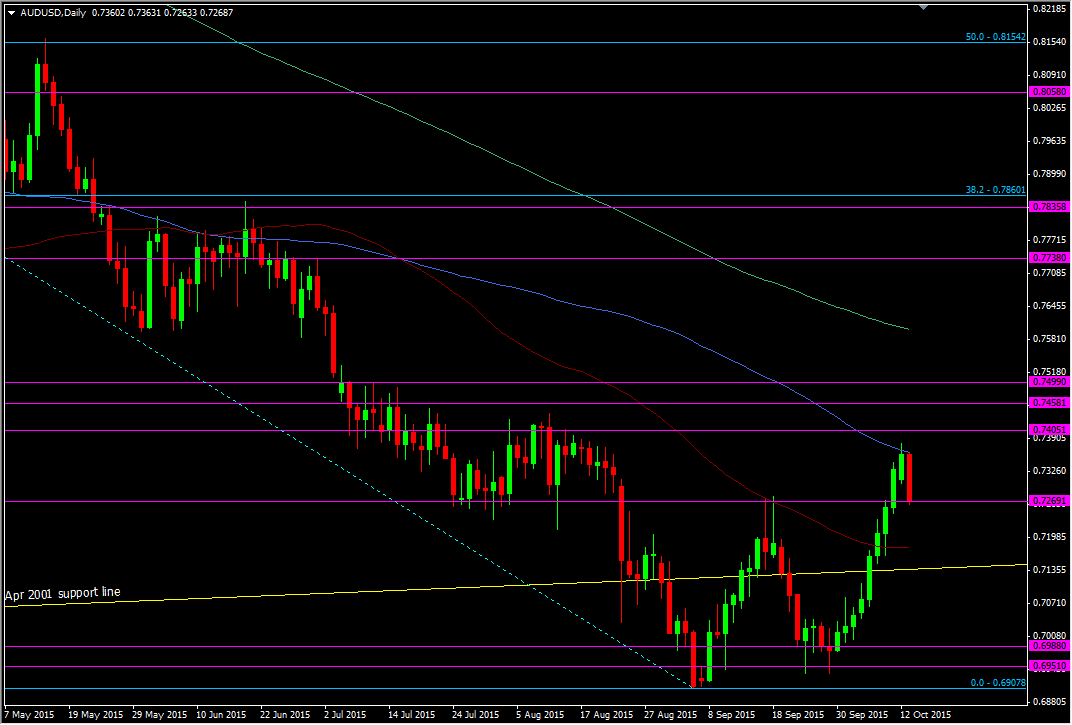

As I type AUDUSD is breaking below an old S&R level at 0.7270 after the recent rally ran out of fuel

The big drop in Chinese imports hasn't helped. The better than expected fall in exports may calm the wider markets but if China isn't buying, then Australia is one country they're not buying from. Throw in the BOJ minutes and the effect on the yen crosses, and a mildly hawkish Lowe at the RBA, and suddenly there's 3 reasons why the longs got out of dodge

Another reason why was the inability to fully break the 100 dma

AUDUSD daily chart

On the technical front the pair had clear skies, then hit a decent level and couldn't make it count. To me that's a big warning signal in a strong move. If this rally is to continue then we need to find a base and down around the 0.7200 area and 55 dma at 0.7180 looks like the best place. If we go below there then we could see a deeper fall back towards the low 0.70's

At the moment we're facing FX moves that often promise much but fail to deliver. Just look at cable. AUDUSD could be the next pair that does that, if it can't hold the levels below