The RBNZ take centre stage later today and the kiwi is ready for action

Eamonn has a great preview on the go;

Preview of the RBNZ monetary policy announcement

Expectations are a tad more balanced than the ECB, although the majority of economists are leaning towards a cut in rates

Cut or not the NZD is going to move so let's have a look at the technical picture and see what's what

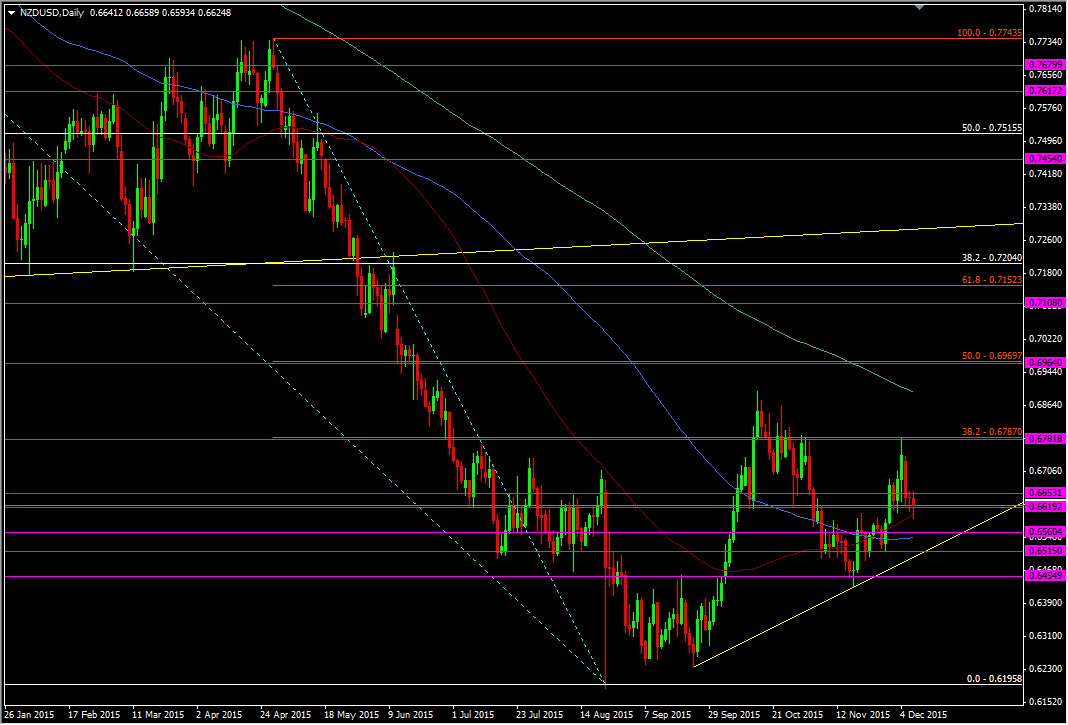

NZDUSD daily chart

For what is likely to be a 25bp cut or no cut but dovish there's a couple of levels either side of the current price that could contain moves on that basis

On top we have the area around the 38.2 fib of the Apr slide at 0.6787 and that coincides with an old 2010 support level at 0.6782. Throw in the 0.6800 big figure and there's enough there to warrant watching the area as a stretch point for an upside move

Looking down, the 0.6500/15 space, and down to the trendline at 0.6495, puts us around 100/120 pips from the current price. If the market gets the cut expected this is the sort of range I'd be looking to see any moves running into trouble. There should be further support around 0.6450 should that not hold. The 55 and 100 dma's are in play also, as is another longer term horizontal line but they may be too close to the price to stand up to a decent move

As is often the case, it's not just the initial announcement that's important but the patter that comes with it. Wheeler will be speaking 5 minutes after the decision and then again 4 hours later to his bosses in parliament

If we get a super dovish tone then we may well be on for a test of the years lows around 0.62. The bigger stand out obstacles in the way of that are 0.6400, 0.6325, 0.6300/10, 0.6260/75 & 0.6250

It all happens happens at 20.00GMT