Strategy from Credit Agricole:

The USD-rally persists ahead of the key event of the second half of the week - the FOMC October minutes. Investors expect further confirmation of their already hawkish expectations.

Starting with the minutes, of particular interest for the markets will be the Fed's assessment of the recent abatement of global macroeconomic risks coupled with the renewed USD appreciation across the board. We suspect that the Fed will conclude that while the former development helped ease the US financial conditions, the latter likely worked in the opposite direction. Indeed, our index of the US financial conditions has recently hit its tightest level so far this year, highlighting that the strong USD and higher UST yields of late more than outweighed the impact of the recovering US stock markets and lower commodity prices.

The October minutes could be perceived as somewhat dovish if they highlight policymakers' concerns about the renewed appreciation of USD and the tightening in the US financial conditions evident in the rates markets. Needless to say, with USD TWI having appreciated by more than 2% since the October meeting, such concerns would have only grown further. We also suspect that even as the upcoming Fed speeches reaffirm market expectations of a December lift-off, they will likely tone down the hawkish message by indications that the glide path for rates could be flatter than expected in September. All that could highlight that a lot of positives have already been priced in in the latest USD-rally so that it would likely take positive data surprises to see USD uptrend extending from here.

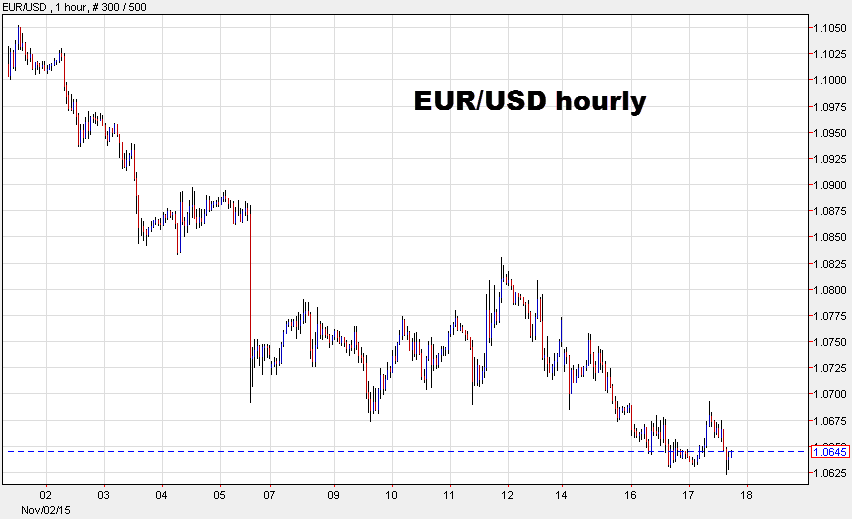

Where next for EUR/USD

EUR was among the biggest G10 losers in recent weeks as investors continued to bet on more easing by the ECB on December 3. It seems by now that a 10bps depo rate cut as well as a QE-extension is priced in by the markets. Draghi and his colleagues may therefore struggle to exceed the already dovish market expectations. What is more, the upcoming ECB minutes on Thursday could signal that there was a range of views at the Governing Council when they were debating the need for additional easing measures in October. That could come as a surprise for some who seem to assume that there is a consensus at the ECB to cut rates and extend QE further next month.

Indeed, the recent FX price action seems to suggest that investors were fairly selective choosing to sell EUR in response to dovish ECB remarks (eg Peter Praet) while ignoring the somewhat more mixed signals from other Governing Council members. We have recently highlighted that the EUR NEER is now very close to what we call the ECB's comfort zone. We think that sustained overshoot below the lows of the year could reduce the chances of aggressive easing. We further suspect that while the ECB will continue to lean against unwarranted FX appreciation they need not necessarily embrace the idea of potentially disorderly moves in the FX markets.

Editor's note: Overall, they don't sound overly excited about the potential for EUR/USD declines.

For bank trade ideas, check out eFX Plus.