All eyes on the stock market now and China tonight but US employment takes center stage tomorrow

The EURUSD squeezed to a high of 1.09395, but the USDJPY did not make new lows. The eyes are on the US stock market 25 minutes to go and current prices are off the lows. China to come and there may well be continued nervousness of another devaluation over the weekend. The off shore Yuan is trading as if they expect it as it trades a wide spread to the on shore version.

Before then we have the US employment report. Oh yeah. The expectation is for a jobs gain of 200K vs. 211K last month. The unemployment rate is expected to remain steady at 5.0% . Manufacturing jobs are expected to remain flat. Average hourly earnings are estimated to rise by 0.2%, the same as last month. The year on year is expected to rise to 2.8% from 2.3%

With the newest focus on the China story, the market will be skittish about a devaluation and the impact. So that may lead to even more event and liquidity risk during tomorrows trade. The risk over the weekend will also be elevated. If you are new to trading, that is code word for be careful. Remember we don't gamble. We trade and trading involves understanding and controlling risk. December can be a flaky month for employment as it is. Tack on the global worries and it spells R-I-S-K.

Remember in August the stock markets tumbled and in September the Fed blinked. Now they easily say it was a mistake, that they should have tightened but that is in hindsight of course. Now it si deja vu all over again, one tightening into liftoff, with global concerns once again. All this goes into the big cauldron and makes you wonder what does happen to the dollar if the NFP comes out 220K and what does the dollar do if it comes in at 170K. Is January a "live" meeting? Are the worries about inflation expressed in the minutes yesterday and the global wobble in stocks an issue?

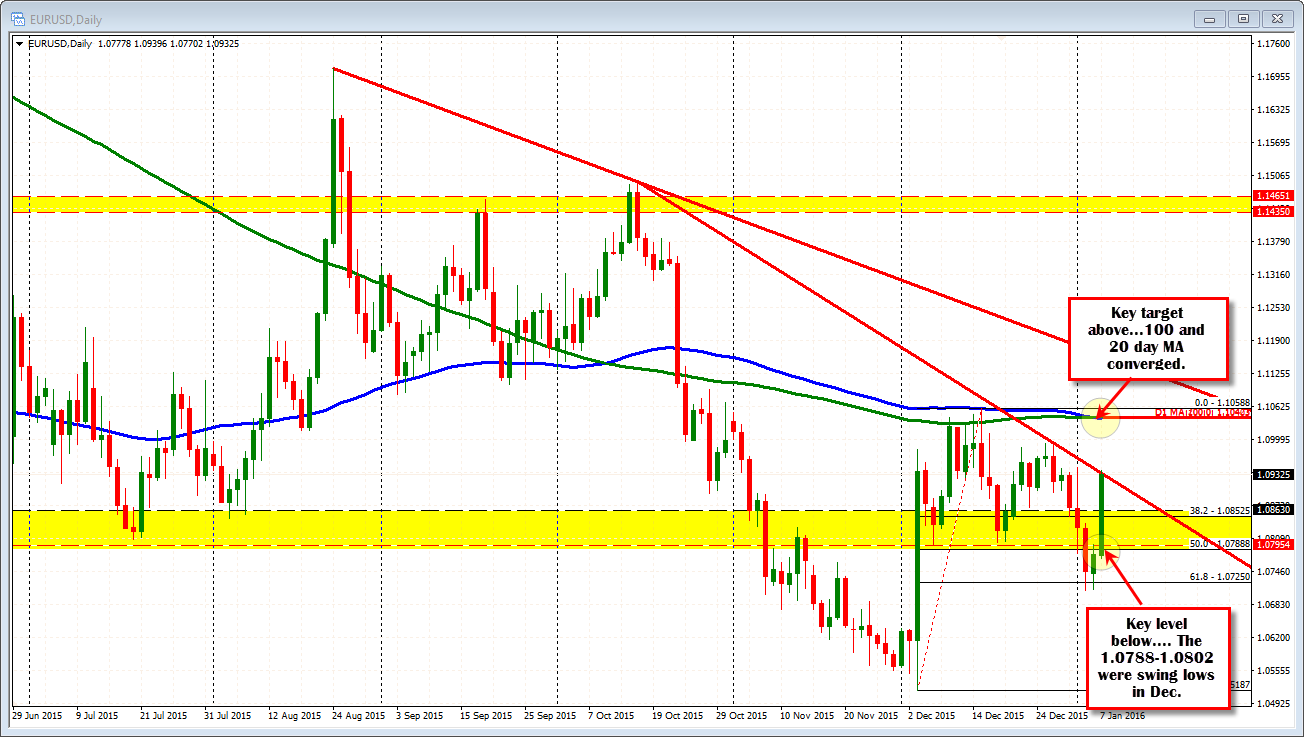

It is hard to map out the roadmap with so much time left between now and then. But if I were to look at the EURUSD on the wide right now, what pops out above is the 100 and 200 dayMA at 1.1050 area. ON the downdside 1.0788 is a favorite of mine still. Those are the wide targets on bullish or bearish moves