We're through the resistance around 109.50 but not getting carried away

Usually when a level holds for a while and looks quite strong, you'd expect to see more of a show when it breaks. That's not been the case for USDJPY around 109.50.

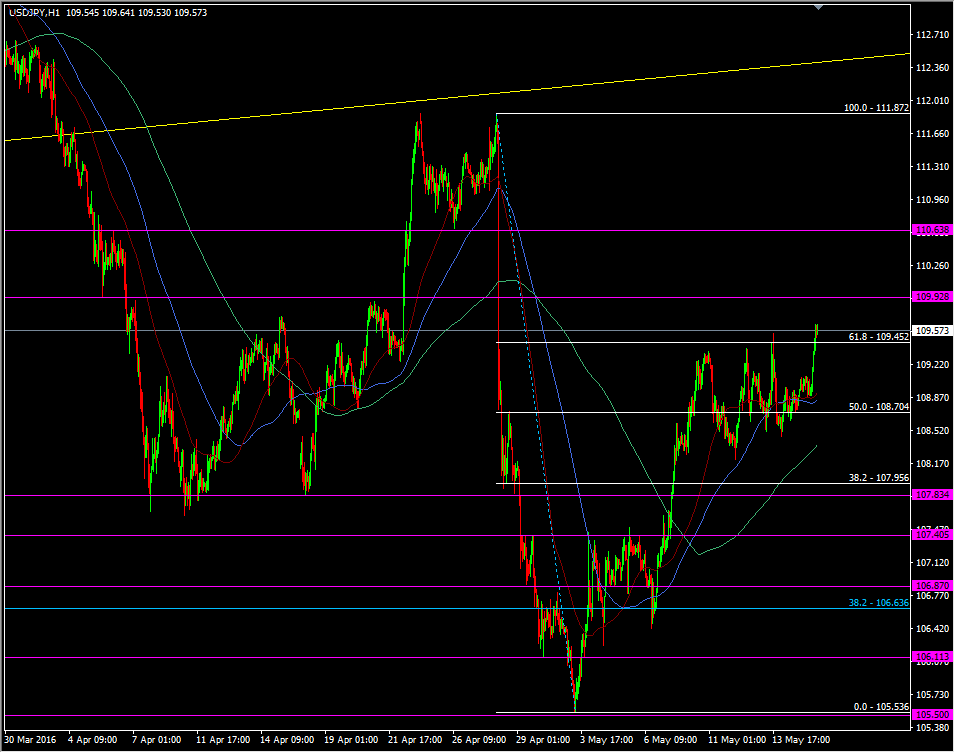

USDJPY H1 chart

The new 109.65 high is pretty pathetic really and keeps the risk high that we fall back through, if we can't develop decent support at the broken level. At the moment we have some support around 109.50 and it's doing the job so far.

The next main resistance starts at 109.85/90 and there will be plenty of it from there to 110.00.

The hourly ma's are providing the cover down below with the 55 H1ma doing most of the work but backed up by the 100 H1 just under. Those same ma's are providing support on the 15 & 30 minute charts too.

We're mostly being led by the yen rather than the dollar but if yesterday's positivity through the US session is repeated then the buck could add fresh impetus and we'll see 110.00 tested. US inflation data could have a big say in todays trading as another push higher in prices will give Fed hawks more ammo for hikes. The core is already above 2.0% at 2.2% but is expected to drop a tick. Headline CPI is forecast to improve to 1.1% from 0.9%. Confirmation of expectations should be enough to help keep USDJPT supported while any upside beat will see the dollar take control across the board.

Keep an eye on the real average weekly earnings too. March came in at 0.2% m/m and 1.1% y/y. A decent jump here will also lend USD good support.