...but only by a pip. Holds above the 109.00 level on the corrective low today

The USDJPY did squeak out a new session high (but only by a pip). The Atlanta Feds GDP estimate may have taken the market a little bit by surprise given the weaker headline retail sales and inventory data this morning (GDP est +0.3 vs. +0.1 last).

The correction of the US data today saw the price dip toward the 109.06 close support level (the low reached 109.02) but has seen a modest bounce. Topside target levels remain at the 200 hour MA at the 109.53 level now (and moving lower each hour). A cluster of resistance is found at the 109.92-977 area where lows and highs and the 38.2% are all found.

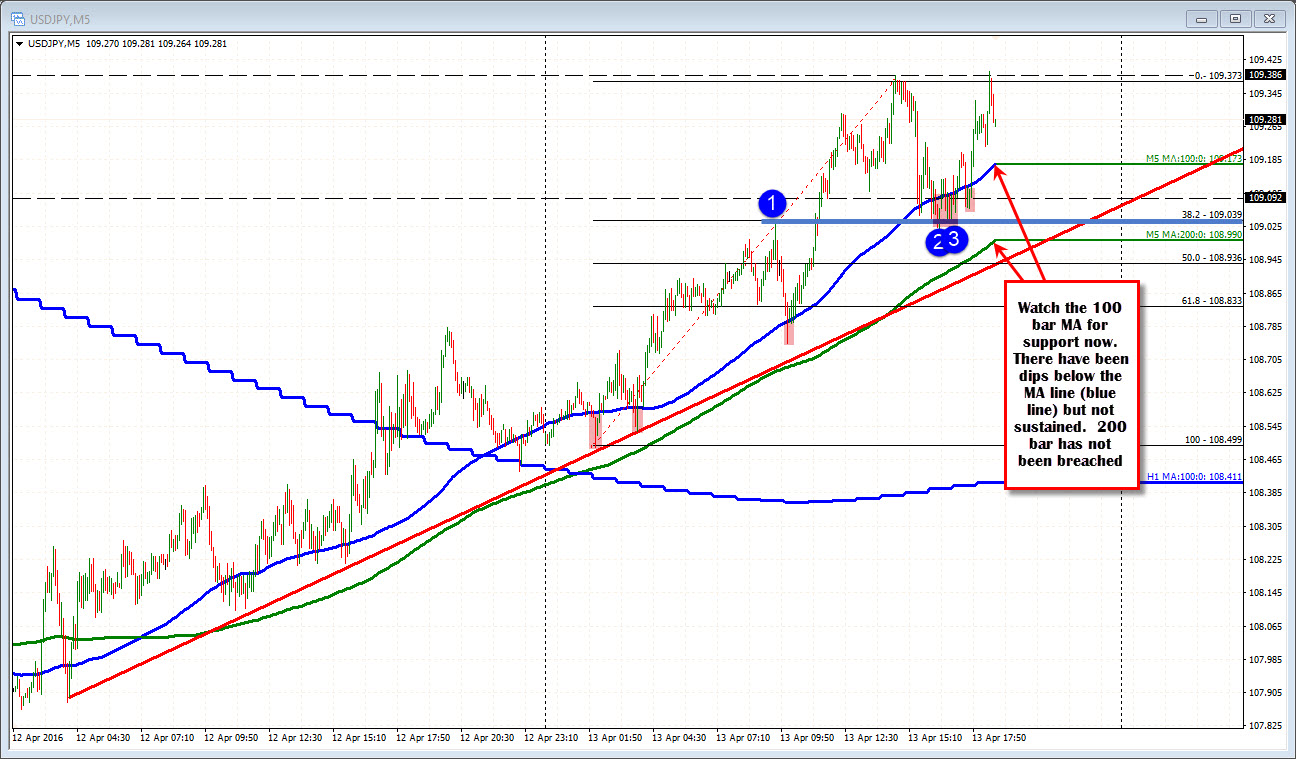

ON the downside now, keep an eye on the 100 bar MA on the 5-minute chart (see blue in the chart below). The price has dipped below that MA on a number of occasions today but breaks have not led to sustained selling. In fact the price has not made it to the 200 bar MA (green line) since breaking above yesterday. If the price can move below the 100 bar MA and stay below, that would be indicative of a topping market - especially given the quick retreat after new session highs.