Last week I highlighted 5 post-NFP trades and another is now active

USDCAD was a pair I was looking to trade in the aftermath of the non-farm payrolls

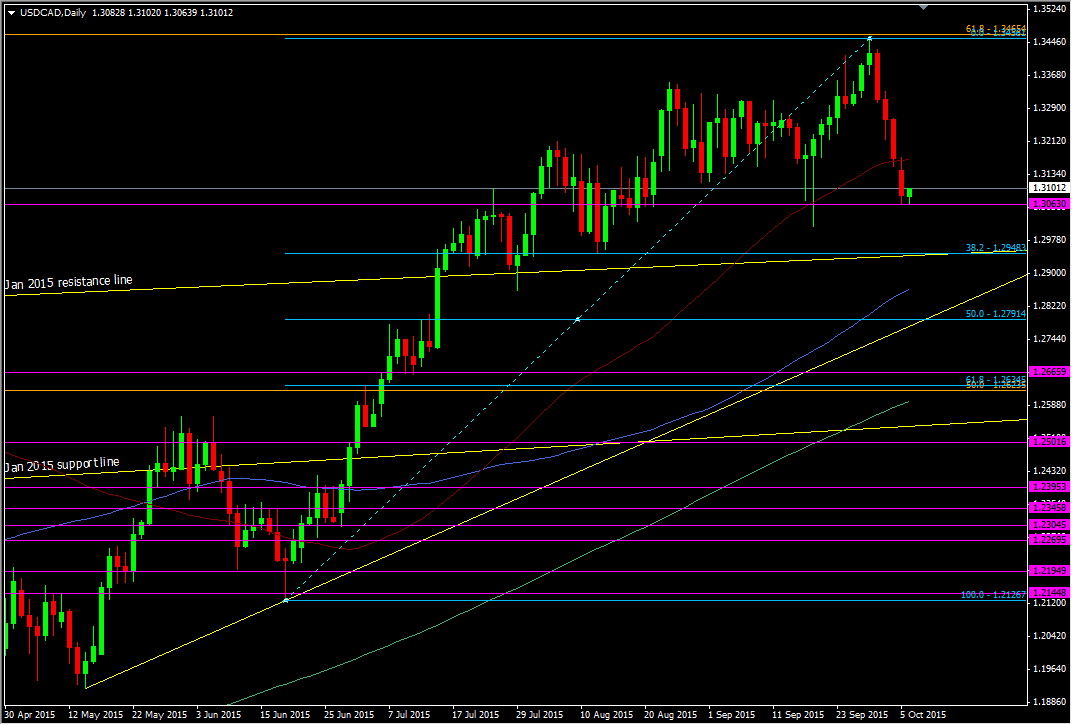

The first level I was looking at was the 55 dma around 1.3166. That was blown through pretty easily and I held off. The next level was the old resistance area around 1.3060/80. It was a very strong level on the way up in July and has usually had a say in things since

USDCAD daily chart

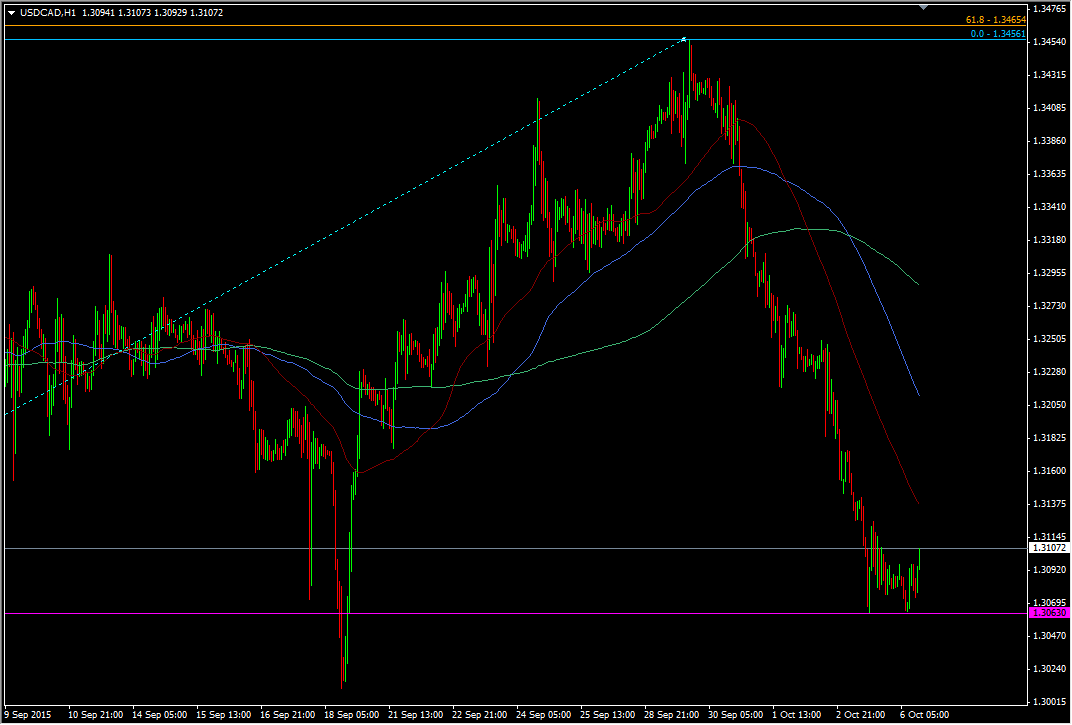

Due to my own incompetence I missed the first drop yesterday but managed to get in at 1.3075 on the next drop though it was looking like the bounce was going to fail.

USDCAD H1 chart

Fortunately the trading gods are smiling on me this time and the 1.3060 level held. So far we're all good. The key test from here is the 55 dma at 1.3170 but there looks to be traffic at 1.3125/30, 1.3140/45 and then 1.3180 & stronger at 1.3215/20

The downside risk is obviously the 1.3060 level and the Sep 1.3010 lows ahead of 1.3000. That's going to be my line in the sand for this trade

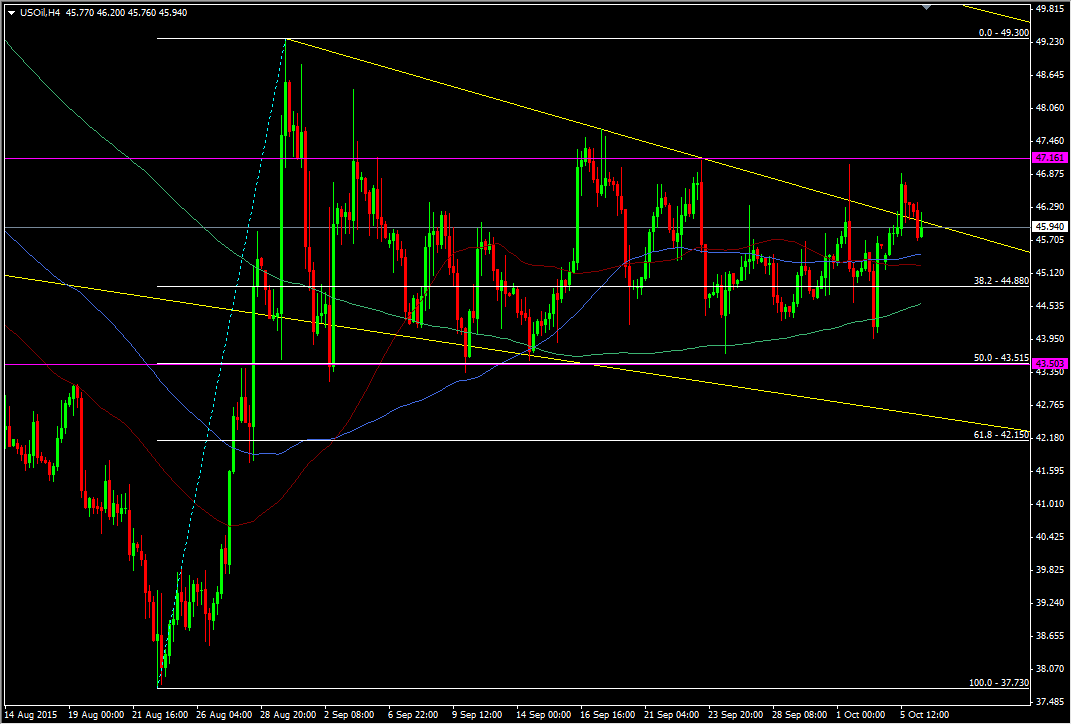

The bias on this trade is that the Fed still aren't out of the rate game and neither are the BOC who are on the dovish side. Oil is the big random but it's not such a risk while it remains within its range and at the moment that's pretty clear

WTI H4 chart

What I am undecided about is my profit target. I still think the CAD is going to be a great buy after the Fed hikes but there's a lot that may happen before then. In this case I think I'm just going to micro manage the trade and see how it does