There's some good signs in the data but not enough to give the buck a boost

In the US good data these days doesn't come in large percentage moves. It seems every month we're just seeing a few percentage points here and there

The retail sales advance missed expectations, but beat last month by a pip. Ex-autos managed a small gain. Core sales looked better but it's all small moves and nothing that gets the juices flowing

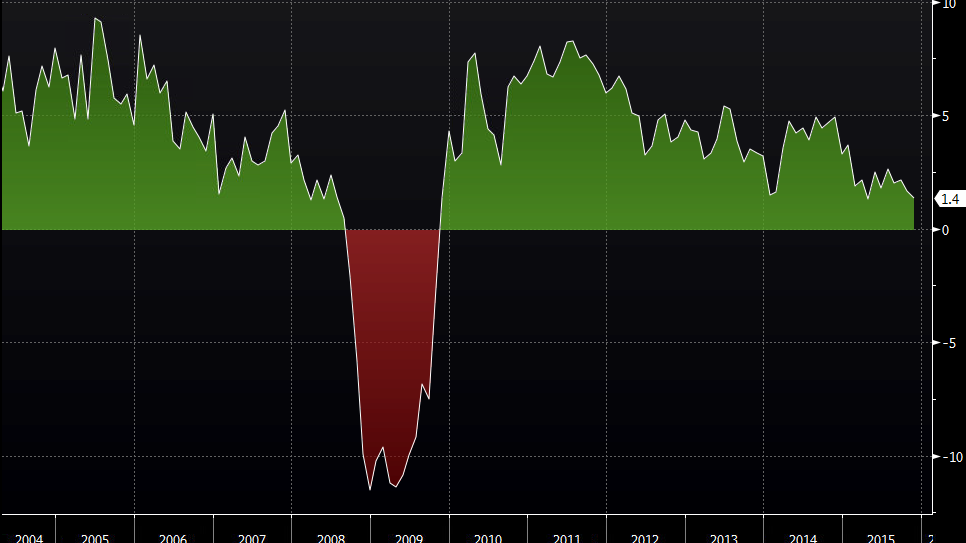

Year on year sales came in up a measly 1.4% vs 1.7% in Oct and the trend this year is pretty clear

US retail sales y/y

There shouldn't really be any expectations to see prices rising in the current environment and again, the gains we have seen aren't busting any boundaries. Services posted the biggest jump in a year. Was it up 4%, 2%, 1%? Nope, a paltry 0.5% was the gain.

This is the environment the Fed are going to be raising rates into. Usually a central bank raises rates to contain an economy that is, or is looking to, overheat. We certainly haven't got that here

There's nothing here for the dollar to get excited about and it's showing that by ignoring the slim pickings of good news, and seeing it for what it really is, an economy going sideways

121.00 is under fire and there's going to be some dollar longs betting on the Fed that might start to feel some heat if we break below