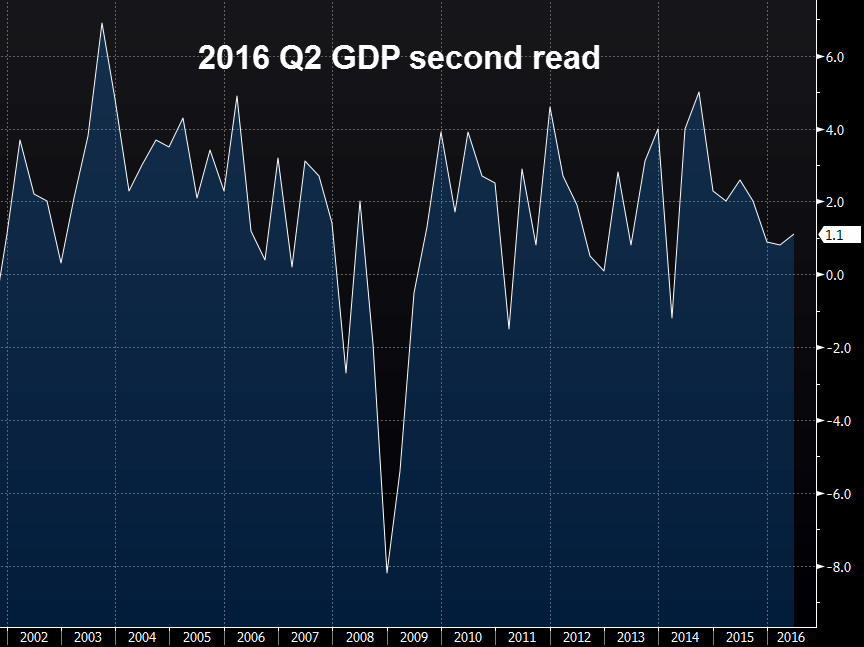

The second reading on US Q2 GDP

- The initial estimate was +1.2%

- Personal consumption 4.4% vs +4.2% exp

- Core PCE q/q +1.8% vs +1.7% exp

- GDP price index +2.3% vs +2.2% exp

- Corporate profits -2.4% (unchanged from first estimate)

- Durables spending +9.9% vs +8.4% first estimate

- Business investment -0.9% vs -2.2% first estimate

- Business investment in IP/software +8.6% vs +3.5% first estimate

- Home investment -7.7% vs -6.1% first estimate

- GDP ex motor vehicles +1.0% vs +1.2% first estimate

The goods news is that business investment wasn't quite as dismal as it looked and the consumer spending was even stronger. The worry is that the consumer isn't going to hold up, especially if auto sales tail off as anticipated.

Overall, after +0.8% growth in Q1 the first half ran just below 1%. We would need +3% growth in Q3 and Q4 just to get back to 2% for the entire year.