ForexLive preview of the September 2015 UK labour market jobs report

Another big data point for interest rate traders to get their hooks into so what should we expect?

The call for tomorrow is a 2.5k drop in claims following the 1.2k gain last month. The unemployment rate is expected to hold at 5.5%

Much like the US, the UK jobs market has been strong. What we have seen though, over the last few months, is a softening of that strength. That's not such a bad thing as the jobs market settles down into some sort of normality, and is something I highlighted back in July

We can see the pattern in jobless claims and the steady drop since mid-2012 that's started to fade over the last couple of months. Historically the falls have been some of the largest in nearly 20 years

UK claimant count change

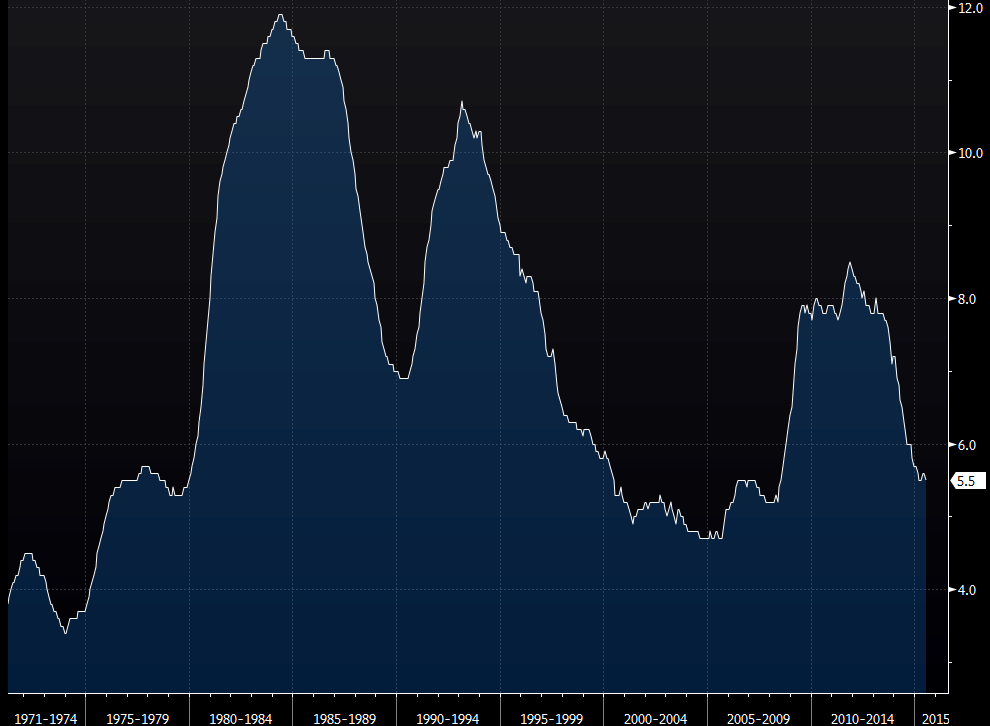

The BOE would like to see the unemployment rate lower but it's not that bad looking historically once again

UK unemployment rate

What's happened since last month?

Using the PMI's as the yard stick, manufacturing was the only report to see lower employment growth overall and job losses in one component, as the report noted;

"Consumer goods sector headcounts rose, investment goods producers made little change in staffing levels and job cuts were signalled by intermediate goods companies."

Both services and construction reported strong employment growth, and both the strongest since June

So indications are that although we may see falling claims flattening, the employment picture is still strong and we have the scope to see further falls in unemployment

How about those pay packets?

As we know, the focus has switched to wages as they are the next piece of the interest rate puzzle. UK wages have always tended to be strong and the latter part of 2014 and so far in 2015 we've seen that strength pick up

UK wages & wages ex-bonus 3m y/y

There's still plenty of room to see further wage gains, and if the market is shifting in favour of the employee then those gains are going to continue coming. Construction is one area that is feeling the heat from an underskilled labour market and is having to pay up for the right people. In one sense that's bad news for employment as it means that those less qualified and unemployed may get looked over. It does, however, raise the churn in the sector and thus wages

For the report, wages are expected in at 3.1% vs 2.9% prior, and 3.0% vs 2.9% prior ex-bonus. As an aside, the private sector has been leading the way but the numbers will be strengthened if we see public sector pay picking up. Most workers in that sector will be saying that's wishful thinking, but you never know

Finally on the wages scene we had the new minimum wage come into effect 1st Oct and that might throw the numbers out. For these figures we could see lower employment if firms are holding back on hiring due to the increased costs. For next month it could mean that we see a bigger jump in wage gains because of the hike. There's been many big retail employers who are not only matching, but beating the governments minimum and that could play out next month.

What's the pound trade over the numbers?

The claimant count is becoming more of a lottery now we're seeing some gains. They could rise, they could fall, and so we should expect that

Wages coming out strongly again will offset any disappointment in claims. Both hitting the right numbers and pound buyers and longs will be singing merrily. A decent rise in claims 15-20k+ and flat wages will see the pound fall. The worst case of a big rise in claims and drop in wages, and it will be cups and saucers in the air

With the market very quick to slam the pound on bad news, it's advisable to lock in any gains on good news at the earliest opportunity

Following the shenanigans before the CPI data today, the same rules apply to this report. A sell off may not mean leaked numbers but purely traders reducing risk ahead of the figures. Given the fall today, we could see the opposite move, and that won't necessarily mean a good number has been leaked. Whatever happens the moves around the CPI data were yet another warning of what markets are capable of

Time to see what the boss has to offer