With the BOE MPC announcement on Thursday (with bonus inflation report) the data this week is going to be very important for the pound and the rate trade

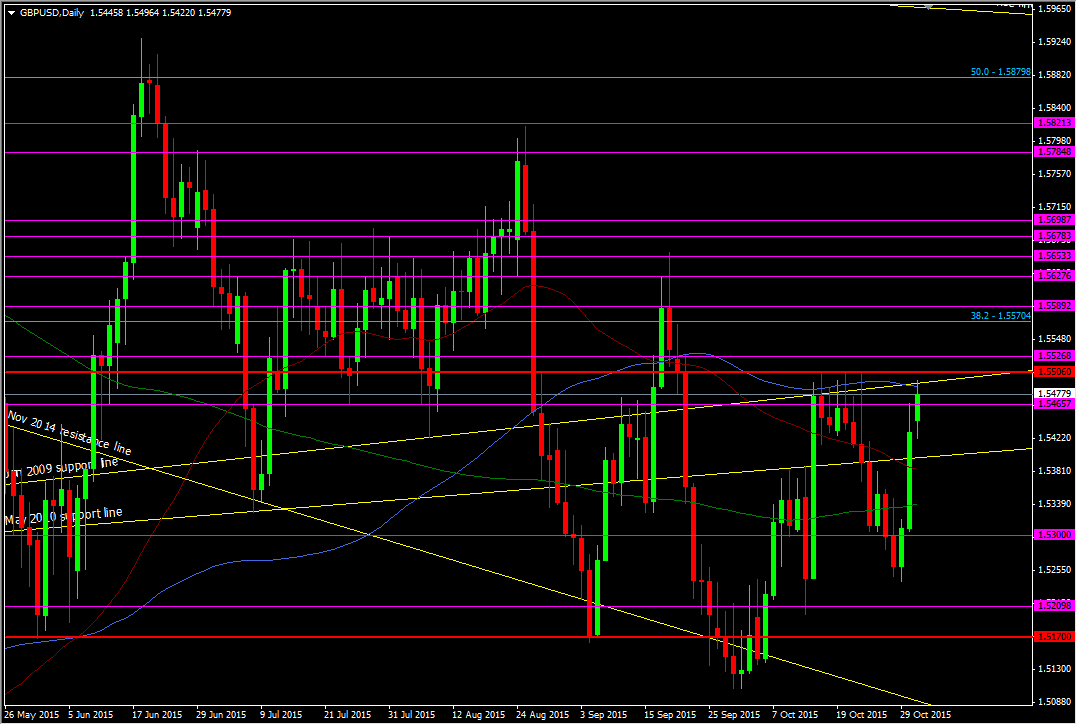

We know the big number that sits above us in cable. 1.5500/10 is what we need to break to potentially see a further run higher.

UK manufacturing has been in a bit of a slump since the recovery through 2013 and this result even surprised me. It hasn't been enough to see 1.55 break and we came 3 pips short

The data this week is going to be looked at very closely given we have the MPC on Thursday along with the latest inflation report. We have construction tomorrow and then the big services report on Wednesday. They are going to have a big say in which way pound traders lean into the meeting.

After the FOMC I wrote that the pound may not be as weak as it had been previously as if the Fed is signalling that they could go in Dec it may see pound traders thinking that the BOE wouldn't be as far behind as the market thinks.

Since then we've rallied over 250 pips and there could be plenty more upside if the next data points come in strongly

GBPUSD daily chart

Although it's a good start to the week the manufacturing sector isn't huge in GDP terms at around 12-15%, and that's a big reason why we haven't broken through 1.55 right now. I think we see the pound maintain its bid tone in the run up to the BOE and so dip buying is going to be the trade this week

There's plenty to come from the US this week to starting with both manufacturing numbers. For me the trade is going to be using any decent US news to get into any decent dips in GBPUSD to run into the MPC. Certainly 1.5300 is a decent level to start loading up if we get there

There's no need to get excited over one data point but it will only take another to bring out the buyers and get the shorts worried. If you're looking for a trade right now then watching for a break and confirmation of 1.5500/10 will be it