Brits get back to their conquering best

Did you know that there are only 22 countries in the world that we haven't invaded?

Us Brits like to travel, it's in our blood. Ok, I'll admit that one of the main reasons is the often crappy weather we get but I digress, when we get half a chance we pack up the string vests and knotted hankies and head to the nearest airport

Over the crisis, and with austerity kicking in, such luxuries took a back seat as people lost their jobs or became worried about the future

One of the biggest signs of a happy and confident consumer is when disposable income increases and starts to be spent on non-essentials

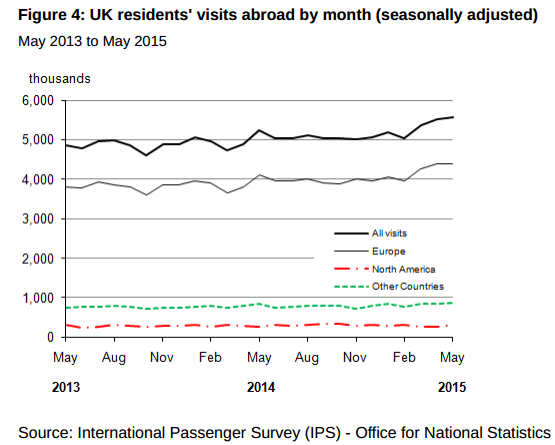

The ONS has released data on the latest travel and tourism data and it shows a good pick up in spending. People travelling abroad rose 8% y/y in May to. Spending was up 8% also to £3.3bn

Naturally Europe saw the bulk of the outflows from the UK with the US and other destinations roughly flat

Now while I'm painting a bullish picture of the UK consumer, the destination chart also shows the pattern of spending. Europe is very close, and has become a cheaper destination with both the moves in the exchange rate and the falling oil prices reducing travel costs. That suggests that although more people are willing to splash out on a holiday, they're still being quite reserved and are not looking at those more expensive long haul getaways just yet

There's also good news for the UK economy with foreign inflows rising 9.0% in May, and their spending increased 8.0%. Total spending in the last 12 months rose 1.0% to £21.8bn

It is a good sign for the economy and sentiment, as confidence grows and more people feel more comfortable spending. And it's these little signs that the BOE will be looking for when deciding on interest rates. It's this sort of data and confidence that leads to inflation rising as when people spend more, more firms are happy to put up prices and try and increase their margins. It's a snowball effect and it can pick up quite quickly

So while the economy is still far from the boom times, it is ticking along and the UK people are still supporting it. In contrast across the pond, the US consumer is still lagging behind the UK consumer in feeling this positivity and we're only now seeing fleeting signs that they're catching up. Just like here, the Fed will be looking at these clues when deciding whether the time is right to raise rates

Adventure all the way