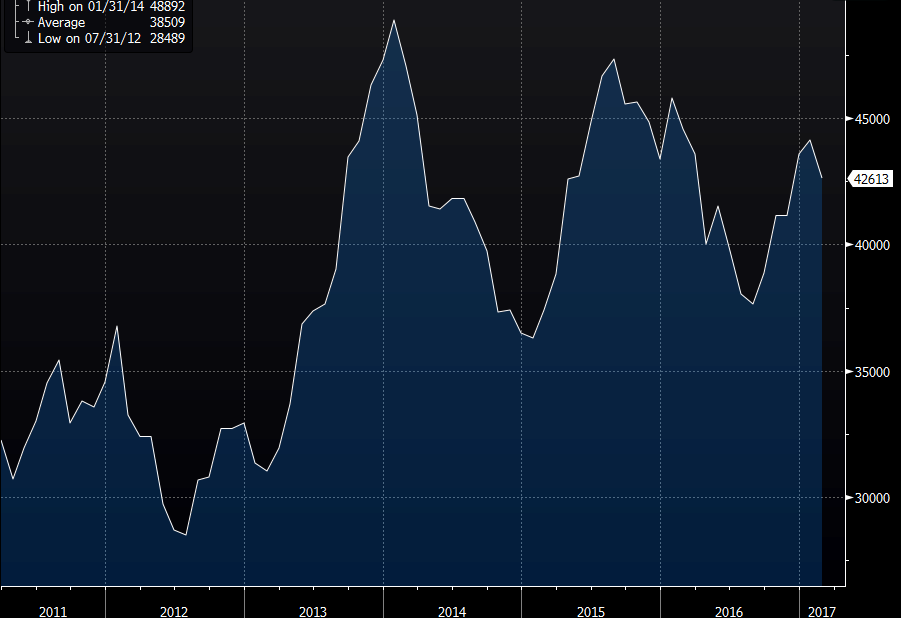

UK BBA February mortgage approvals

- 44,142 prev revised down from 44,657

- net mortgage lending GBP +1.95bln vs 1.94blh prev

- mortg approvals down 4.6% yy

- consumer credit +6.6% vs prev

- credit card lending +0.3bln vs +0.1% prev, highest since March 2016

Household debt on the rise still but that's not a positive imho. I've warned on that for a while now and one good reason why the BOE should be/have been careful about hiking rates.

Says BBA:

- mortgage approvals returning to average levels seen in most of 2016 from elevated levels over winter

- businesses continue to take cautious approach to borrowing, favour cash reserves and alternative lending sources

GBPUSD still hanging around 1.2495 with EURGBP unable to breach 0.8650

The British Bankers' Association (BBA) Mortgage Approvals reports the number of new mortgages approved by BBA member banks during the prior month. It comprises more than half of the total U.K. mortgage market.