Three Fed speakers are on the agenda. What they've said lately.

The recent slate of Federal Reserve speakers has been largely dominated by the hawks.

Fischer has often talked about raising rates in public and he was joined by like-minded Fed Presidents like Mester, George, Kaplan and Lockhart.

The tables turn on Wednesday when three Fed doves take centre stage.

At 0715 GMT Boston Fed President Eric Rosengren and Chicago Fed President Evans speak in Beijing. The topic of Rosengren's speech is "Observations on Financial Stability Concerns for Monetary Policymakers,".Evans is on a panel after the discussion but the PR from the Chicago Fed said he will also discuss current economic conditions and monetary policy.

Evans will undoubtedly be dovish. He last spoke Aug 3 when he said it's worthwhile for the Fed to wait for 2% inflation and that one hike this year could be appropriate.

Rosengren is the one to watch

Rosengren is more of a wildcard. He has a reputation as a dove but in April/May he was more optimistic. He's been quiet since June 6 when he said in a speech that three conditions that would make it appropriate to further raise interest rates - a rebound in spending (growth from the Q1 level), continued strengthening of labor markets, and additional progress toward reaching the Federal Reserve's 2 percent inflation target.

Growth was just 1.1% in Q2, the May jobs report released 3 days before that speech was terrible but was followed by a pair of great numbers, and inflation is at the same levels it was then.

His growth forecast was for "a little bit over 2%" in 2016 and it will take +3% growth in the next two quarter to get there.

A few weeks before that, on May 23, he spoke with the Financial Times and had a line that boosted the US dollar at the time. "I would say that most of the conditions that were laid out in the [April] minutes as of right now seem to be . . . on the verge of broadly being met."

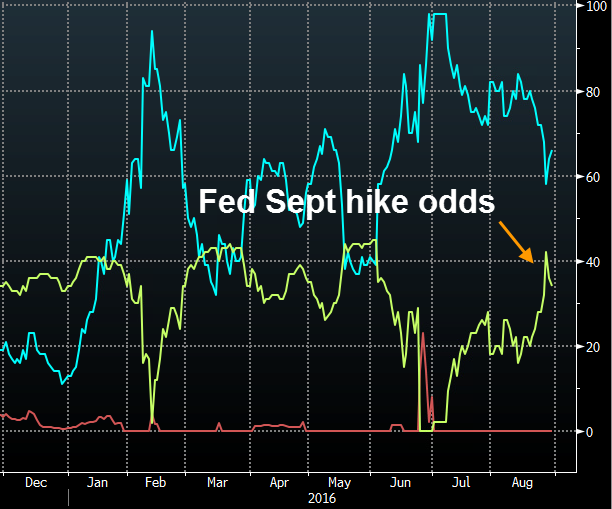

So there is a risk that he repeats a similar comment this time and the dollar could benefit but he might also be wary of pushing up Fed hike expectations above the 34% currently implied in the Fed funds futures market.

Third on the agenda is Kashkari at 1200 GMT. He's been in the news lately for twitter fights but in June he said the Fed should take its time in raising rates. He had a similarly dovish angle on Aug 3 when he said there was still room in the jobs market to put people back to work and that he doesn't see much inflationary pressure.

The topic of his speech Wednesday is the structure of the Fed and its role. He will take questions from the audience but not the media. In general, he's not shy about expressing his views.

Finally, note that the main bit of economic data on Wed is the ADP employment number. Just like it did in May, a weak reading could take a hike right off the table. Other economic reports due are the Chicago PMI and pending home sales.