Goldman Sachs abandons short-gold trades

There's nothing better than being on the other side of a Goldman Sachs trade idea. The latest example is gold, which they've been forecasting would fall to $1000 since September.

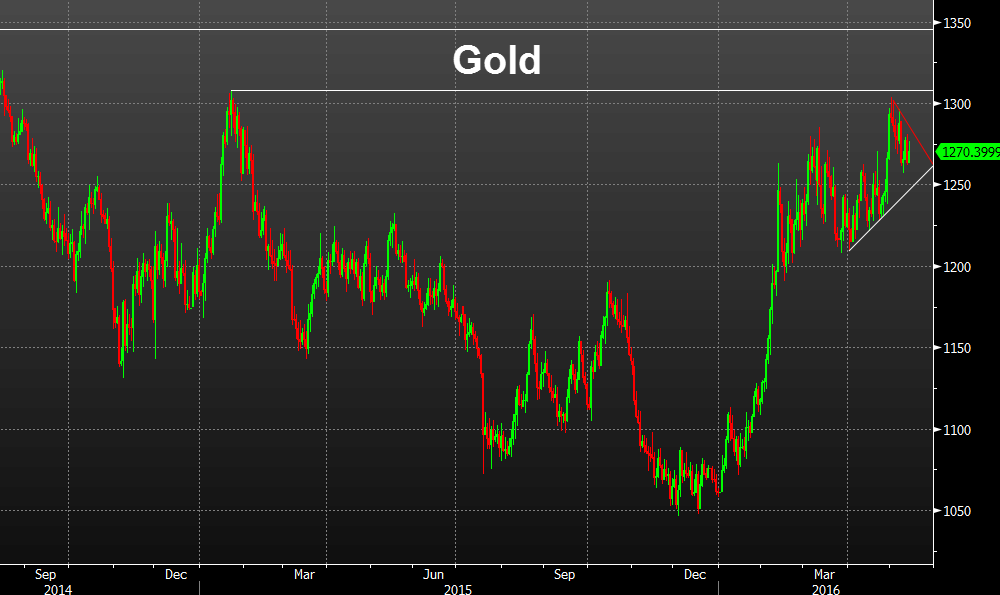

Instead, it's been one of the best performing assets this year, trading at $1270 today and posting its best quarter in 30 years in Q1.

In a note dated May 10, Goldman Sachs analyst including Jeff Currie and Max Layton have now cut raised their three month forecast to $1200 from $1100. The six-month forecast to $1180 from $1050 and the 12-month forecast to $1150 from $1000.

They cited US dollar weakness for the shifting call but still remain (lightly) bearish in what might be a small comfort for the bulls.

"Looking ahead, we see limited upside for gold pricing given the limited room for the Fed to surprise to the downside, limited room for the dollar to depreciate, and limited room for China to drive (emerging market) currency strength to contribute to dollar weakness" the bank said in its note.

One person on the other side of the gold trade is Stanley Druckenmiller, who said to buy gold last week.

Technically, the gold chart looks constructive but is struggling with the January 2014 high.