US dollar slammed after FOMC

1. The Fed is worried about global growth

The big change in the statement was inserting a line saying "Global economic developments continue to pose risks." Yellen further emphasized the point in the press conference by singling out China, Canada, Mexico and Europe as spots where growth has disappointed.

2. The Fed discussed inserting a negative balance of risk

The Fed removed the balance of risks assessment in the January statement and left it out again this time. The thinking among market participants and economists were that if it returned, it would tilt hawkishly. Not so, said Yellen. She said that some FOMC members saw it as neutral and other saw risks tilted to the downside.

3. Lower rate expectations balanced global risks

The outlook for US growth is about the same. It would have been lowered due to global growth but that was offset by markets pricing in fewer rate hikes.

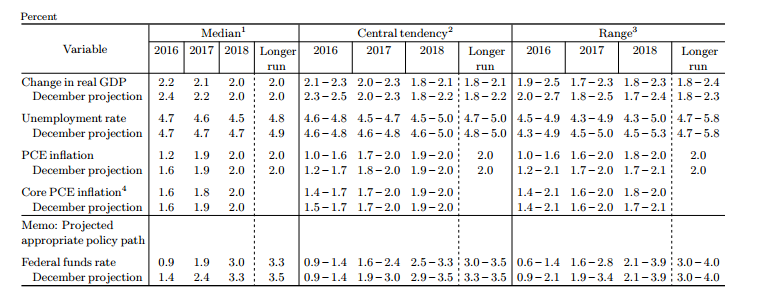

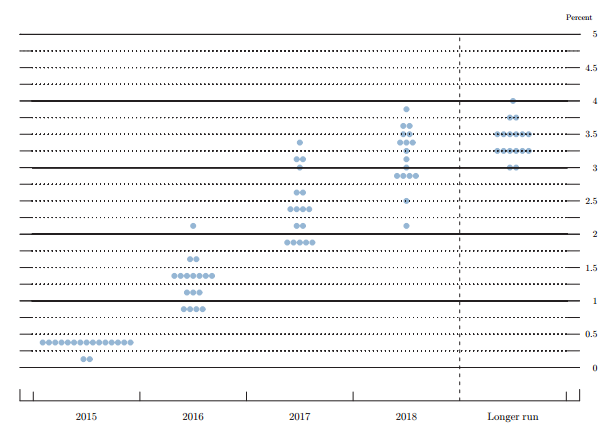

4. Two hikes on the dot plot

The median in the Fed dot plot fell to two hikes this year from four. Yellen continued to emphasize that every meeting is a live meeting but she in no way indicated that a June hike is a high probability.

5. Inflation forecasts are low

The Fed cut the 2016 inflation forecast to 1.2% from 1.6% and all the bands of inflation forecasts top out at 2% out to 2018. That has to be viewed in tandem with expectations of rate hikes that are built into forecast but it's remarkable that the Fed is unworried about recent upticks in inflation. Yellen said she believes they're transitory and sees no convincing evidence of wage inflation.