US income and spending data is another mixed bag

Looking at the breakdowns of the numbers, we're seeing incomes higher but we're still not seeing a matching jump in spending.

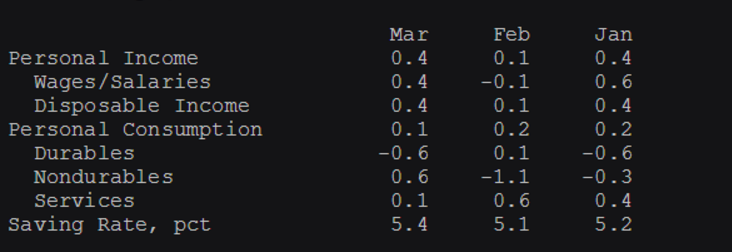

Wages and disposable income both rose 0.4% but spending was flat-ish. We saw durable spending -0.6% while non-durables rose 0.6%. Services only showed up a pip.

Income and spending

We know that US earners are saving more because they're still not confident in the economy. We've been going on about that for a while. The longer that goes on, and if we do see the economy showing real sustained strength across the board, we could see the floodgates open on those savings and then spending really taking off. There's many boxes that need to be ticked before then though.

The US is on the right path but we're not seeing massive gains anywhere. The Q1 spending numbers we're up but not as good as last quarter. Gains are gains though and they all add up.

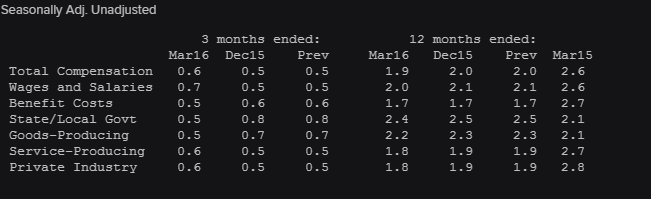

Q1 employment cost and wage details

The Fed is scared that these numbers aren't strong enough to hike into. They've come far enough for one hike, to get the ball rolling but they are worried that more hikes will tip them back south. We'll need to see some pretty strong numbers between now and June to bring another hike into the frame.

The reaction in the dollar speaks for itself. There's nothing here to swing the rate trade either way. 107 has held out and we're inching higher but again, we saw that happen yesterday before things blew out into the second half of the US day. Keep the levels in mind, go with the flow and don't get overextended in any trades.