The dollar can't get traction

In the past week, the US dollar is the worst performing major currency.

Let's do a quick recap at what we've learned in the past seven days.

- Trump revealed that a phenomenal tax plan is coming in a week or two

- US retail sales smashed expectations

- Inflation numbers were higher than expected

- Today's Philly Fed exploded higher to the best in 32 years

- The Fed Chairman was surprisingly hawkish, as were other Fed members

- The odds of a March hike moved up to 36% from 26%

What's more, the US dollar is the worst performing major currency in 2017. Granted, some of that is a give-back from the Nov-Dec rally but starting from election night, the US dollar is a mixed back outside of USD/JPY.

Why isn't the dollar higher?

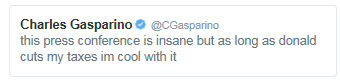

The stock market clearly loves the everything about the election and Trump. He's promised tax cuts, less regulation, more spending and better growth. The 12.7% rally in the S&P 500 says the stock market believes it. Ten-year Treasury yields have also moved up to 2.45% from 1.82%.

Given all these facts and correlated markets, there is absolutely no question the US dollar should be higher.

Why not? I believe that worries about the strong dollar policy are real and they're having an impact.

On top of that, I think there's an international divide. US investors have decided they can live with Trump and the checks and balances in Congress.

International investors, meanwhile, aren't so sure. To some extent, that makes sense because the tax rule changes might not be so warm to foreigners and protectionism might make them want to bring their money home.

But even when Trump is bizarre and defensive, he still has good people working with him on legislation and plans. The thing is, one of those plans might be to weaken the US dollar.