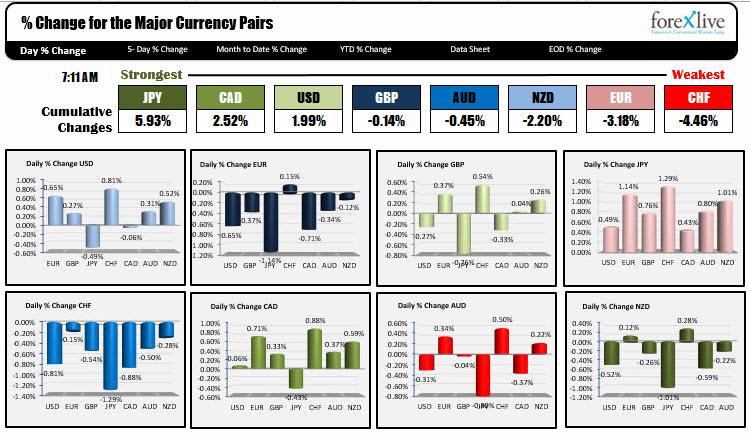

January 5, 2015. JPY is the strongest. CHF is the weakest.

As North American trader enter for the trading day, they are once again prepping for further declines in equities - albeit less so than the greeting on the 1st trading day of the year. European indices are negative (Euro stoxx -0.51%, Dax -0.60%, Cac -0.61%). The Nikkei and Shanghai composite were down as well (-0.42% and -0.26%). The early call for the US indices are showing declines (S&P down about 11 points, Dow down about 100 points). The declines has the JPY as a safe haven currency and as a result, it is the strongest currency of the majors.

In Europe the CPI data was weaker at +0.2% vs +0.3%. That has the EUR on the defensive. The EURUSD is trading at the lows for the day as NY traders enter. The CHF is following along after it's up and down action yesterday. The USDCHF is also trading at the sessions extreme (i.e. at the high for the day). The EUR and the CHF are the weakest currencies in the morning snapshot. The AUD and the NZD are lower as well as traders sell risk.

The USD is on balance stronger with gains against the EUR, GBP, CHF, AUD and NZD. However, it is down against the CAD and the JPY.

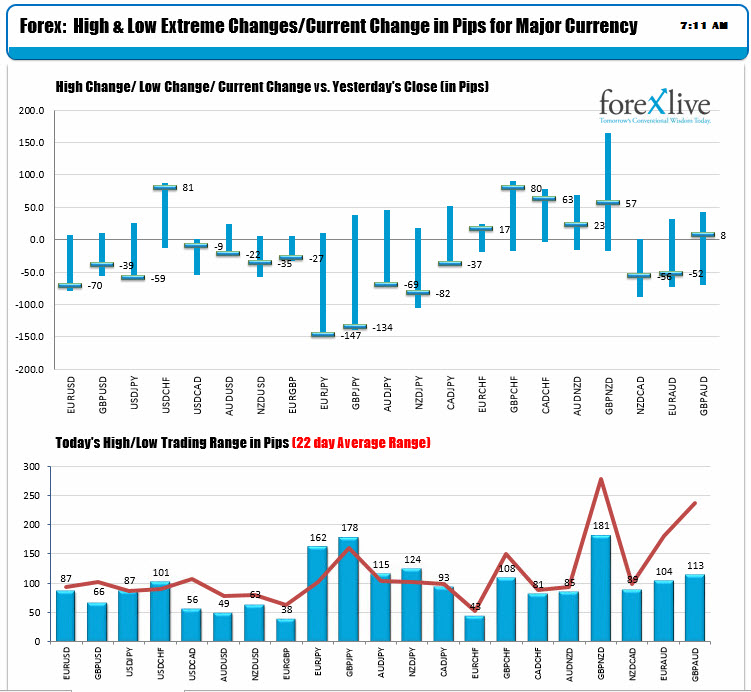

The trading ranges for the major pairs are ok but not great. The USDJPY and the USDCHF have ranges at or above the 22-day average (about a month of trading). The GBPUSD, USDCAD, AUDUSD and NZDUSD lag. The JPY crosses are showing life with all above the average trading range, and all trending to the downside. Each of the JPY pairs are trading at - or near - the days lows (see charts below).

The action is in the JPY with the markets focus on stocks. US auto sales will be released with expectations of 18.1M pace expected for total vehicle sales. The ISM New York index will also be released. Last month the index came in at 60.7. Canada PPI (0.0% est) and Raw Material Price (est -2.5%) will be released at 8:30 AM ET.