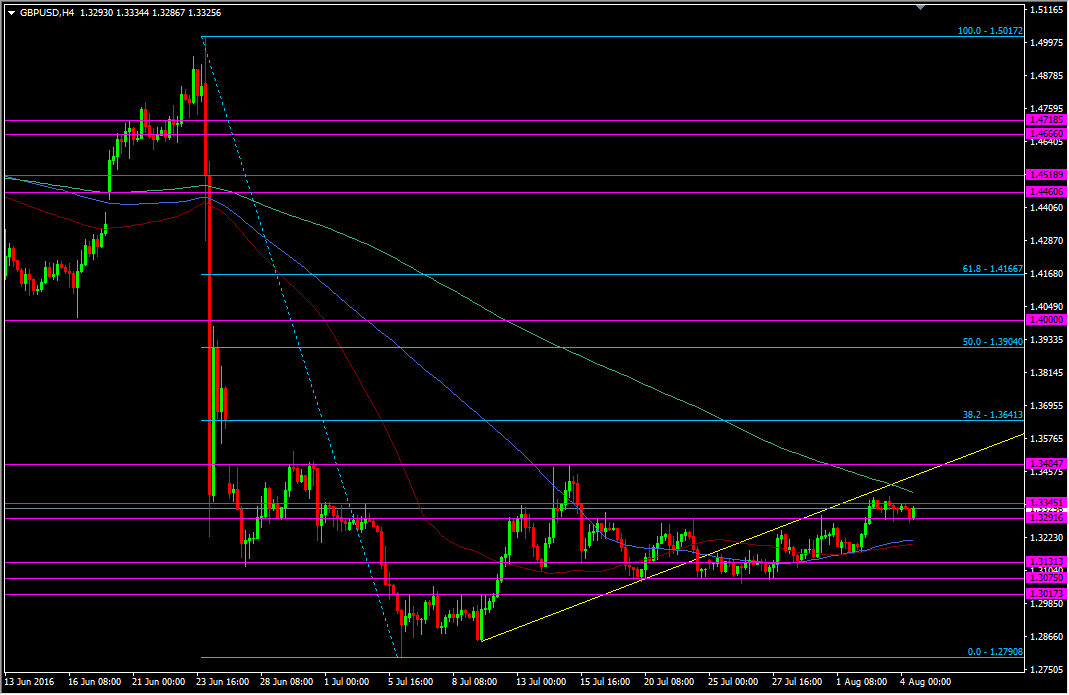

Here are the levels to watch in GBPUSD

Up

1.3345/50 has been a hard level for the price to stay above when its tried recently. It's too close for any initial reaction, but as we saw with the BOJ, these levels can play a part if the price moves away and then comes back

1.3381 is the 200 h4 ma and where we doubly likely to some support coming in ahead of 1.3400

1.3440/45 is the underside of a broken support line from 11 July. It also corresponds to the late highs from 15th Jul on the H4 chart

1.3485/90 & 1.3500 a potentially big number here. On the Brexit way down this became a very strong support area from around 1.3550 to 1.3500 (after the first blow through). One reason it showed itself as a big level was that it was the Jan 2009 low. The break was very decisive and it immediately found 1.3500 as stiff resistance. In fact, the bus was parked around 10 pips below at 1.3490, such was the strength of sellers to keep it below. 1.35 has only broken twice and each time it hasn't lasted. This looks to be one of the key areas for shorts and whether they can hold it, or whether they'll start exiting some positions on a break

1.3520/50. This area, as I stated above adds a bit more to the resistance picture. If you're looking to trade a 1.35 break, you'll need to see this area cleared too as a strong failure might be enough to send it back down through the big figure

1.3600 is the next stand out level by the fact it's a big figure, expect some resistance ahead of it.

1.3641 is the 38.2 fib of the Brexit drop

1.3653 was the Mar 2009 low. Not a consideration on the way down but it might be on the way back up.

After that we've got a bit of blue sky to 1.3700 and the 1.3750/60 area that marked the last high on the h4 before the second drop through 1.35

From there, again the levels are a bit sparse and came in some very volatile trading. It will be best to just look at the big figures and half figures until we get up to the 50 fib at

Topping everything though, is the 1.40 level, and that's not going to go without a fight but it's likely to be well out of reach for today at least.

Down

We've got intraday support around 1.3275/80

Stronger support comes in around 1.3200 and is aided by the 200 H1 ma and the 55 and 100 H4ma's

The price has leant against those ma's since 27th Jul through to yesterday from 1.3130 through to 1.3160/70. 1.3130 has been support at various times since the Brexit drop. It's done less of a job as resistance on the times it broke

1.3110/15 protects 1.3100

1.3070/80 has kept 1.31 breaks from running too far. 1.3050 picked up the pieces when it didn't.

1.3015/20 support and resistance around 1.3000

Under 1.30 things may get a little hairy as shorts eye the lows once again. 1.2975/80 may try and limit the damage from a 1.30 break but other than that it could be a quick trip down to the low 1.29's

Break there at 1.2875 is likely to protect the 11 July lows at 1.2850. Under that it's 1.2800 and the year low at 1.2790

Under there it's shut your eye's, hold your nose and jump.

GBPUSD H4 chart

You all know what this pair is capable of. The whole Brexit situation is one big mess of unknowns. These levels may play out or the may be ignored. At some point the market will settle and the tech will come back into focus. Will the bigger risk might be the BOE disappointing the shorts, the downside may be equally achievable if those shorts are given ammo by the BOE to push it back down. Trade safe and keep a tight leash on your trades and account.