But is the tune about to change? Into the 12th day

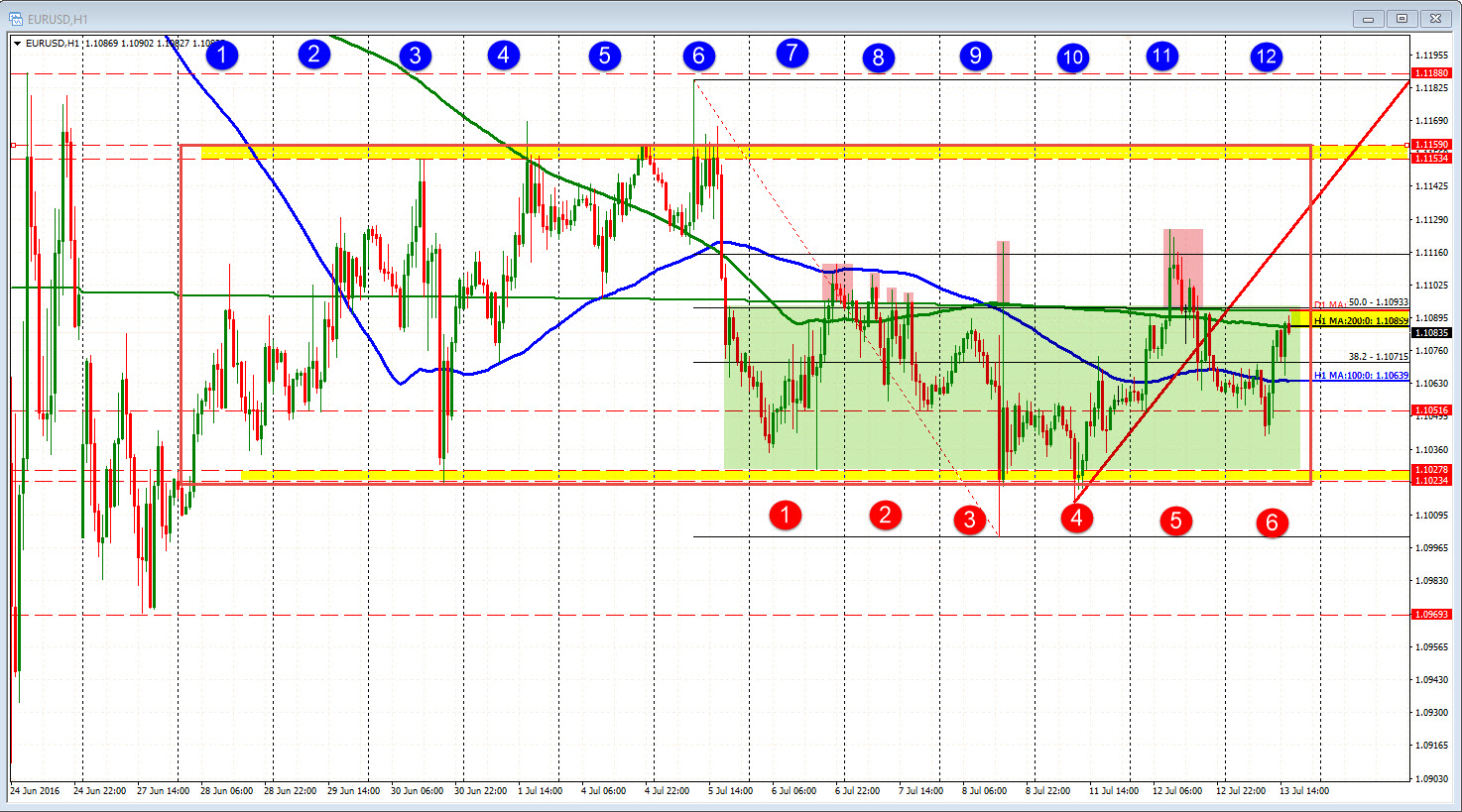

The EURUSD has been confined in a narrow trading range over the last 12 trading days. On the inside, the pairs range is about 135 pips. ON the wide, the range is about 185 pips. There have been a few bars that have made the extremes on the top and the bottom, but overall, the I would define the range from 1.1159 on the top, to 1.1023 on the bottom. That ain't a lot.

Drilling down from there, the last 6 trading days has seen the price trade mainly below the 200 day MA (currently at 1.10933 - overlayed in the chart below). I count 9 hourly bars that closed above the 200 day MA. That is out of 141 bars. So the sellers have had their shot at taking it down (green area). Have they been that successful? They have not been able to sustain momentum. The dip this morning held the 100 hour MA (blue line). HMMMM.

Often times in a sideways market, the "market" will give a bias a chance. "Here is the chance sellers to take the price down. Do you want to do it?" . If it cannot do it, they give up and try the other way.

The EURUSD is trying to get back above the 200 day MA (and the 50% of the 12 day range at 1.1093 now. If now is the time to try the upside instead, we should see follow through buying on a break above. Need to see/feel like the market wants to stay above that level and then build from there.

Just a hunch in the drill down from what I see. Maybe I am hearing a different tune. Are you?