CitiFX on EUR/USD technical analysis:

A backdrop that is positive for growth and inflation should have a feedback loop into Fixed Income that results in higher yields. This should also serve as a boost on an interest rate differential basis and we would therefore see the potential dynamics we outlined in the introduction as USD positive, particularly against EUR and JPY.

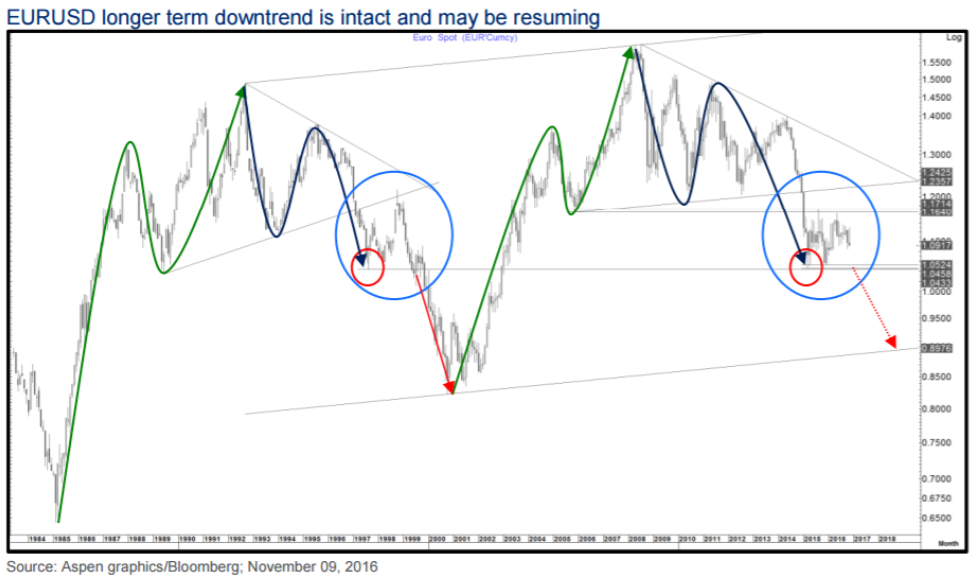

The long term chart of EURUSD also shows similarities with the late 1990s. Then, we fell to an interim low of 1.0433 in August 1997 before entering a multi-month consolidation. That low was retested 21 months later in May 1999 and the subsequent break below there saw a resumption of the downtrend.

This cycle we posted an interim low at almost the exact same level (1.0458) in March 2015 after which EURUSD entered a multi-month consolidation.

A similar dynamic would suggest we could be re-testing the low by December 2016 and a subsequent break below there could signal the resumption of the downtrend.

Interest rate differentials continue to move in favor of the USD, a dynamic we expect to continue. This further supports our bearish bias for EURUSD.

For bank trade ideas, check out eFX Plus.