Swiss National Bank out with their Q1 2016 results 28 April

- valuation gain of CHF 4.1bln on gold holdings

- forex positions +CHF 1.2bln

- CHF appreciation resulted in total exchange rate losses of CHF 6.9bln since Jan 2015

- CHF 333m of negative interest charged on sight deposit accounts since Jan 2015

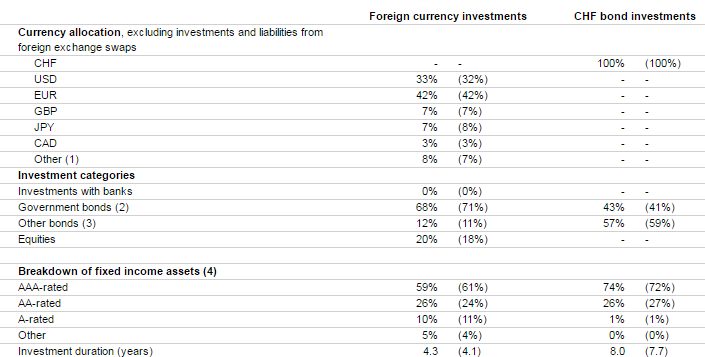

- 33% of forex holdings in USD at end Q1 VS 32% prev, 42% EUR unchanged

- 7% JPY, 7% GBP both unchanged

The news will cheer the SNB shareholders but the figures are not surprising given the SNB/market's intervention to drive EURCHF higher.

Currently 1.0992 still underpinned with USDCHF 0.9700 near session lows shadowing EURUSD again.

Full results here. Reserve holdings here.