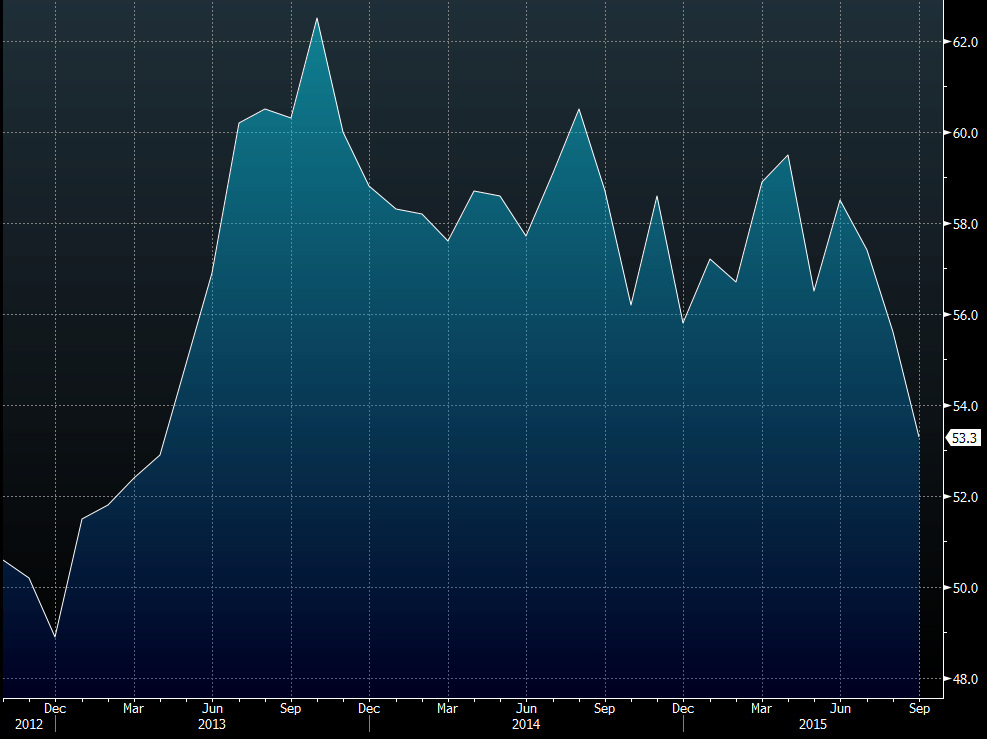

Highlights of the September 2015 UK Markit CIPS services PMI data report 5 October 2015

- 53.9

- New orders 55.0 vs 56.2 prior

- Expectations 68.8 vs 70.7 prior

- Compisite 53.3 vs 54.9 exp . Prior 55.1

- New orders 54.6 vs 55.8 prior

Ouch. Not a good number. Services at their lowest since Apr 2013. Markit says that it all points to Q3 GDP of 0.5% q/q and entering Q4 at a rate of 0.3% q/q

Markit say that survey company clients were hesitant over placing new orders due to global uncertainty. on the positive side, employment was stronger in Sep and prices paid rose solidly due to wage rises. Output prices were marginally up

"Weakness is spreading from the struggling manufacturing sector, hitting transport and other

industrial-related services in particular. There are also signs that consumers have become more

cautious and are pulling back on their leisure spending, such as on restaurants and hotels. Wider business service sector confidence has meanwhile also been knocked by global economic worries and financial market jitters.

At the moment, sustained strong hiring in services and construction suggests that companies are generally expecting the slowdown to be short-lived. But with the three PMI surveys collectively recording the weakest inflows of new business for two-and-a-half-years, there's a strong likelihood that the slowdown could intensify in coming months." Said Chris Williamson at Markit

Overall it's a bad report lined with some silver. The market will be worried that the UK's biggest sector is slipping and that it's something more than temporary. Only time will tell on that front. The wages news is consistent with the current trend and that's a big counter to the negatives. On balance the market will go with the economic impact of the report so this might turn the pound back down into the bearish trend we've seen of late

UK services PMI