USD/CHF trade recommendation from Credit Agricole:

Unstable risk sentiment as driven by continuing uncertainty over Greece kept the CHF in demand for most of the week, at least until the SNB surprised markets by announcing additional policy measures targeted at weakening the capital flow situation.

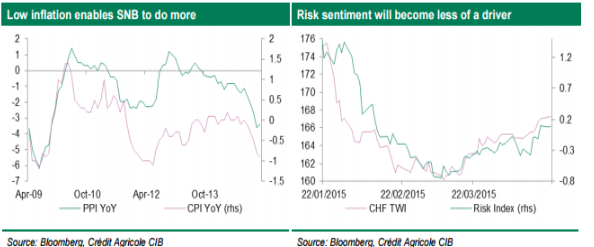

It reduced the group of sight deposit holders that is exempt from negative rates, a move which penalises all those holding CHF-denominated cash. More importantly, the latest development reinforces the view that the SNB will not hesitate to do more if needed in order to ease monetary conditions.

Given still-slowing price developments and the overvalued CHF, we do not rule out additional policy measures being considered in the months to come.

As such, we advise against buying the currency around the current levels, especially against the USD, which should benefit anew from more supported Fed rate expectations.

Credit Agricole entered USD/CHF early this week from 0.9675 with a stop of 0.9250 and a target at 1.0300. They're about 125 pips underwater at the moment so you're getting the trade at a discount if you believe in it. I think it would be a wiser move with a stop just below the April low of 0.9481.

If you'd like trade recommendations from banks, check out eFX Plus.