Bank of America / Merrill Lynch on the Federal Reserve's Federal Open Market Committee meeting on Wednesday this week

(Reminder - announcement due at 1800GMT on Wednesday 21 September 2016)

While the FOMC is unlikely to deliver a rate hike, the committee will have to communicate that a hike is still likely before the end of the year. This means that the communication will have to sound cautiously hawkish, which is not an easy task. Here is a roadmap of our expectations:

Statement communication: risks are now balanced

The most important change to the statement will be the description of the balance of risks. In the July statement, the FOMC noted that"near-term risks to the economic outlook have diminished"....but they continue to monitor inflation indicators and global economic/financial developments. We expect this to be changed to sound more upbeat. The Fed could possibly follow the playbook from last year, noting that the"risks to the outlook for economic activity and the labor market are nearly balanced", while stating that they will continue to monitor these risks (particularly global economic/financial developments and inflation indicators). This would be a natural evolution for the Fed - risks were skewed to the downside in the spring, they were diminished by late summer and are currently balanced.

In addition to changing the balance of risks statement, we think the language will generally sound upbeat about real activity. Despite the slowing in job growth in August, we think the FOMC will note that the labor market continues to strengthen, reinforcing that the Fed follows the trend in job growth rather than a single report. We also suspect that the FOMC will maintain the language that economic activity has been expanding at a moderate pace. We do not expect any significant changes to the inflation language given that the data have largely been as expected and inflation expectations have remained range-bound.

Economic projections: introducing 2019

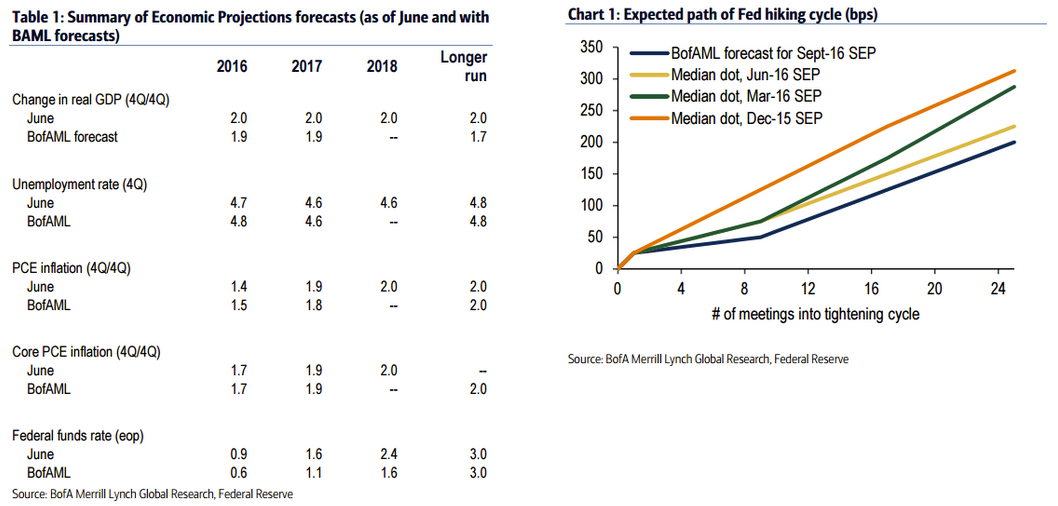

As well as introducing forecasts for 2019, the Fed will have an opportunity to refresh assumptions for 2016-18. Given weak growth in the first half of the year, we think there is a risk that the median forecast for GDP this year is revised lower to 1.9%, which is consistent with our forecast (Table 1). We think the Fed will otherwise leave forecasts at 2.0% for the remainder of the forecast horizon. The unemployment rate remains sticky as the labor force participation rate (LFPR) has surprised to the upside relative to expectations. We therefore think it is possible that some Fed officials plug in more optimistic forecasts for the LFPR, resulting in an upward revision to the unemployment rate to 4.8% in 4Q this year from 4.7% previously. We do not expect changes to either headline or core PCE inflation.

The crystal ball gets foggy as we look toward 2019, which will likely leave Federal Reserve officials to plug in forecasts close to the long-run assumptions. We expect the median forecast for GDP to be 2.0% and we expect the median for both headline and core PCE inflation to settle at the 2.0% target. It will be interesting to look at the range of forecasts -it is possible that a few members pencil in above 2.0% inflation for 2019, implying that they anticipate overshooting the inflation target due to accommodative policy. We think the median forecast for the unemployment rate will be 4.5% or slightly below in 2019, reflecting the view that NAIRU is lower and that the Fed would like to see further tightening in the labor market.

Dots to shift lower (yet again)

We expect the majority of participants to adjust to just one hike this year, moving the median to 0.625% from 0.875% in June. It is possible that one or two participants stick with 2 hikes (likely Kansas City Fed President George and Richmond Fed President Lacker), but it should not prevent the median from shifting lower. This could also be offset by a dovish FOMC official shifting to no hikes for this year. Importantly, we think that the curve will shift lower while keeping the same slope (Chart 1). In other words, we continue to look for three hikes in 2017 and 2018, which will bring the median forecast to 1.375% and 2.125%, respectively. We are looking for the Fed to continue with the pace of three hikes per a year in 2019, leaving the median at 2.875%, just below the long-run expectation of 3.0%.

The self-identified outlier - St. Louis Fed President Bullard - will likely maintain his views. We do not expect any of the other FOMC officials to join him at the bottom. We do, however, think there is a risk that the dispersion of the dots increases, reflecting both the hawks and doves becoming more convinced of their views. Boston Fed President Rosengren has increasingly embraced a more hawkish stance, reflecting concern over the costs to the financial system from easy policy. However, on the other end, it appears that a greater share of FOMC officials are focusing on the challenges from a low short-term R* which could prompt these members to pencil in a more shallow cycle.