Reserve Bank of Australia decision due Tuesday

The RBA decision is due out at 0430 GMT and market expectations have taken a sharp turn since last week's CPI report.

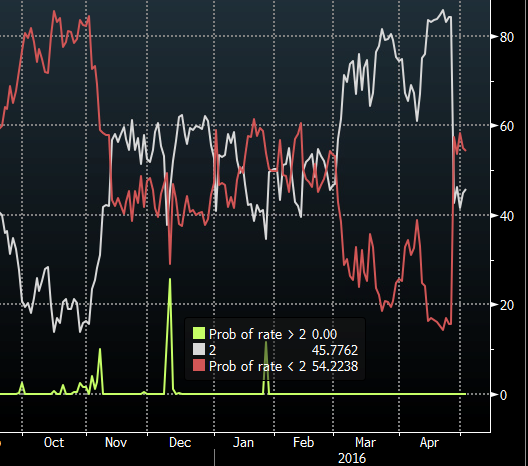

Before the inflation data, the market was pricing just a 15.7% chance of a hike. Since then, that's jumped to 54.2% in the overnight index swaps market.

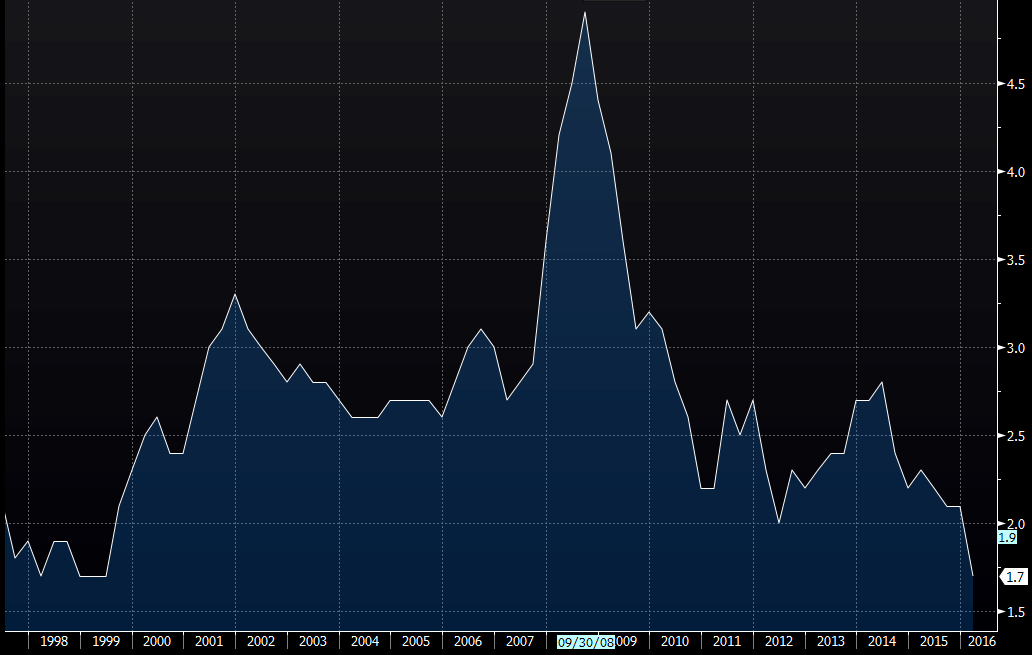

Core inflation, called the trimmed mean, in RBA-speak is at the lowest since 1999. Moreover, RBA governor Glenn Stevens has seen how currencies in Japan and New Zealand soared after central banks there didn't deliver action. He's chronically worried about the strong Aussie and knows the only path lower is by cutting rates.

What's equally interesting to the cut debate this month will be signals about further interest rate moves.

If a cut comes today, the market still doesn't see a large possibility of more cuts coming afterwards. There is a 43% implied probability of a second cut (or more) before year-end and a 17% chance that rates don't fall this year at all.

What to watch for from the RBA

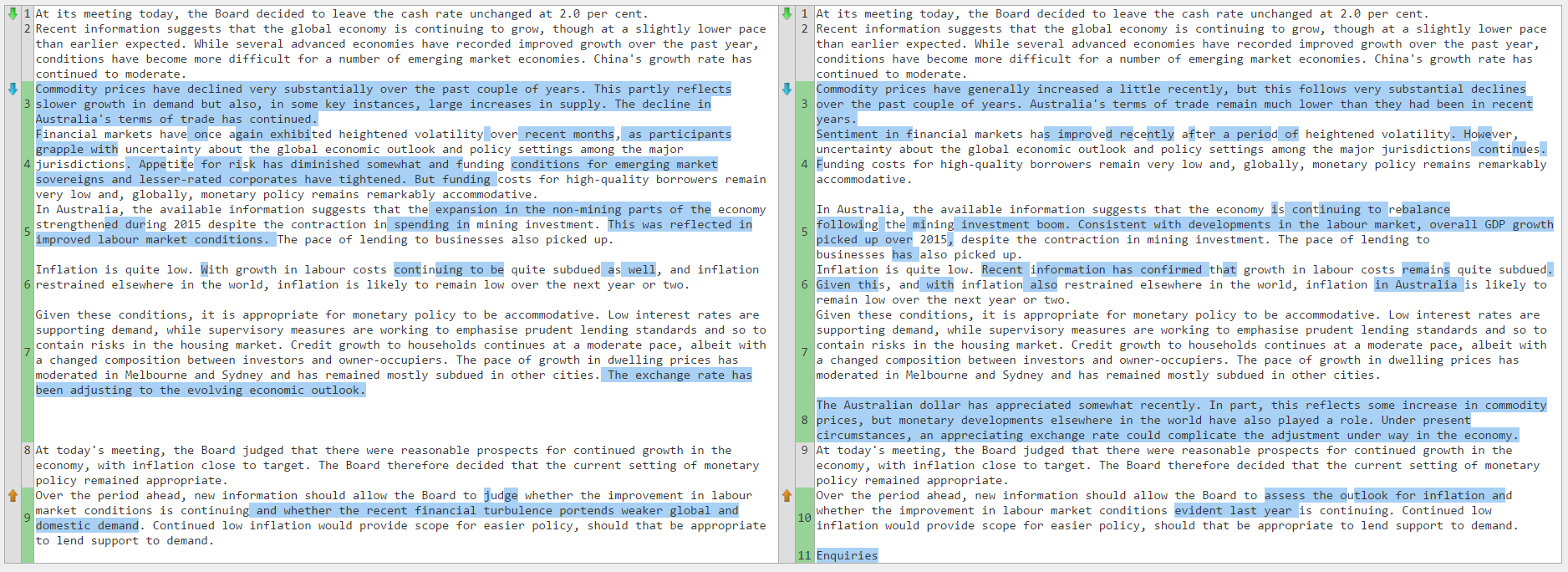

Here is the comparison between the April 5 statement and the March decision. The latest decision is on the left.

The main thing to note is the change in Australian dollar comments. The latest statement said.

"The Australian dollar has appreciated somewhat recently. In part, this reflects some increase in commodity prices, but monetary developments elsewhere in the world have also played a role. Under present circumstances, an appreciating exchange rate could complicate the adjustment under way in the economy," the statement by Stevens said.

At the time, AUD/USD was about a cent lower than the current 0.7656 level.

Contrast that with the March 1 statement when Stevens said, "the exchange rate has been adjusting to the evolving economic outlook."

AUD/USD was at 0.7100 at the time.

Time for a move

It's clear that the RBA wants the Australian dollar lower but that's been a theme for years and Stevens' success has been mixed at best. What I believe will motivate him to make a move this time isn't hope to move the currency lower, it's fear that if he doesn't act, it will rally much higher.