Minutes from the October Reserve Bank of Australia monetary policy meeting

- Judged holding rates steady "at this meeting" consistent with inflation, growth targets

- Board noted Q3 CPI, updated economic forecasts would be available at next meeting

- RBA to consider housing, labour and economic outlook, effect of past cuts at November meeting

- Reasonable prospect of sustaining economic growth, gradual rise in inflation

- Considerable uncertainty remained about momentum in labour, housing markets

- An appreciating AUD could complicate economic rebalancing

- While housing risks had declined in past year, sector needed to be watched closely

- Q3 GDP growth looked to have run at similar pace to Q2

- Rising commodity prices likely lifted terms of trade in Q3

- Household consumption mixed, retail sales slow but consumers upbeat on finances

- Labour data also mixed, extent of underemployment pointed to spare capacity

- Growth in China seemed to have stabilised, but debt a source of concern

These quick Headlines via Reuters

Full text: Minutes of the October 2016 Monetary Policy Meeting of the Reserve Bank Board

-

Earlier today from the RBA:

- More from RBA Lowe: Further AUD appreciation from here would complicate adjustment

- RBA's Lowe: Australian interest rates already very low

-

Simultaneously the New Motor Vehicle Sales for September out:

+2.5% m/m

- prior +0.1%

For the y/y, +0.8%

- prior revised to +2.8% (from +2.9%)

-

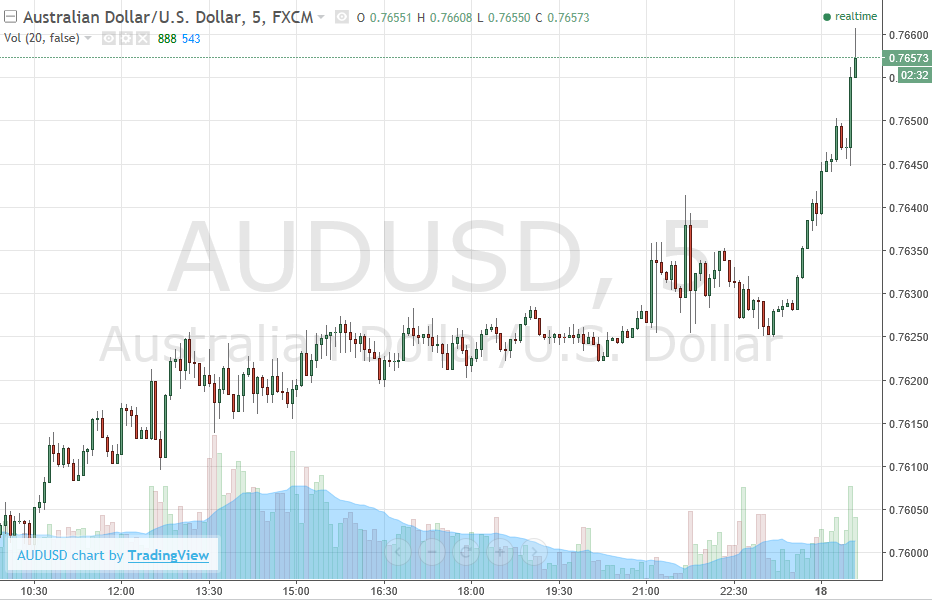

AUD on the move higher again:

The Minutes read almost like Lowe's speech earlier ... themes the same. Which I suppose is not surprising.

I said earlier in my assessment of Lowe's speech that I though it binned prospects for a November rate cut (barring any shock) and the minutes reinforce that ...IMO at least. I guess a caveat is the "Board noted Q3 CPI, updated economic forecasts would be available at next meeting" ... which leaves the door ajar.