Minutes from the Reserve Bank of Australia May monetary policy meeting

Appreciating AUD could complicate economic adjustment

- Members discussed merits of waiting for more information before cutting rates at may 3 meeting

- On balance, members were persuaded that a rate cut would help inflation return to target over time

- Members noted recent data on inflation and labour costs had been lower than expected

- Recent developments had not led to a material change in economic outlook

- Very accommodative monetary policy helping economy rebalance following mining boom

- Lower AUD since 2013 assisting economy, but a rising AUD would complicate this

- Members noted a recent rally in commodity prices was not expected to boost mining investment

- Growth outlook for Australia's major trading partners had been revised a little lower since February

- Chinese growth had moderated further in Q1, more stimulatory policy should provide support

-

Full text Minutes of the May 2016 Monetary Policy Meeting of the Reserve Bank Board

-

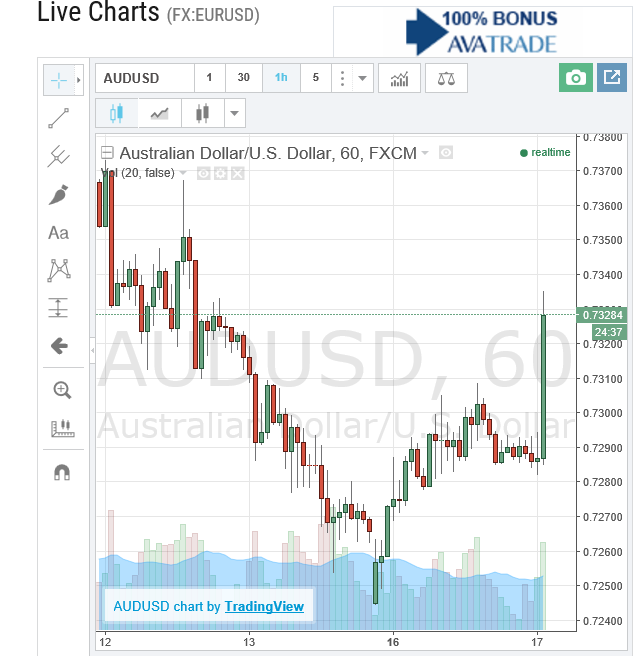

The stop losses I noted earlier above 0.7315 and 25 triggered

The minutes were being looked to give indications on the likely path of monetary policy, like when we can expect the nextbrate cut (they often come in pairs, not just a one off). A lot of the analysts are calling for an August cut next and I don't see the minutes here dissuading many from that. June is looking unlikely.

Concerns on inflation in the minutes, which is hardly surprising, it was the low, low CPI that had prompted the May rate cut after all.

Apart from inflation, a few pieces from the discussion on the domestic economy:

- given the apparent flexibility of the Australian labour market over recent years, members noted the possibility that labour cost growth could pick up sooner or by more than expected as labour market conditions improved.

- Employment growth had slowed in the first quarter of 2016, although members noted that it had remained stronger than population growth over the past year.

- Leading indicators of employment had been somewhat mixed

- The unemployment rate had been around 5¾ per cent in recent months and was expected to remain around this level over the next year or so before gradually declining over the forecast period

- no material change to the forecasts for growth in the Australian economy, although the unexpected strength recorded in the latter part of 2015 had led to an upward revision to year-ended GDP growth in the near term

Long story short - growth doing OK, unemployment rate expected to fall. No strong concerns here.