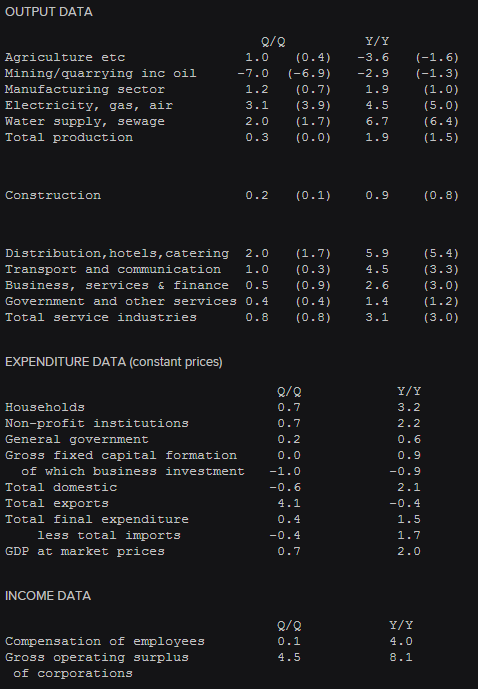

Details from the Q4 2016 UK GDP 1st revision data report 22 February 2017

Prelim 0.6%. Q3 0.6%

- 2.0% vs 2.2% exp y/y. Prelim 2.2%. Q3 2.2%

- Exports 4.1% vs 2.0% exp q/q. Q3 -2.6%

- Imports -0.4% vs 0.3% exp q/q. Q3 1.4%

- Private consumption 0.7% vs 0.7% exp q/q. Q3 0.7%

- Business investment -1.0% vs 0.1% exp q/q. Q3 0.4%

- -0.9% vs 0.3% exp y/y. Q3 -2.2%

- GDP deflator 0.7% vs 0.3% q/q in Q3

- 2.8% vs 1.8% prior y/y

- Dec index of services 0.2% vs 0.1% exp m/m. Prior 0.3%

- 0.8% vs 0.8% exp 3m/3m. Prior 1.0%

A real mixed bag here. Better quarter but lower on the year. Exports jump a big chunk but investment sinks.

If I had to pick a side quickly before going through the rest of the details, I'd say this looks more negative than positive.

The ONS say;

- Information, communications tech and 'other' machinery pulled down the business investment

- Better q/q number due to better industrial production

- 2016 GDP revised down due to inventories and weaker exports

Another negative comes from the income data and employee compensation which rose 0.1% q/q vs 1.3% in Q3. Year on year it stood at 4.0% vs 4.5% in Q3.

I'm keeping to my initial assessment that this isn't a good report.

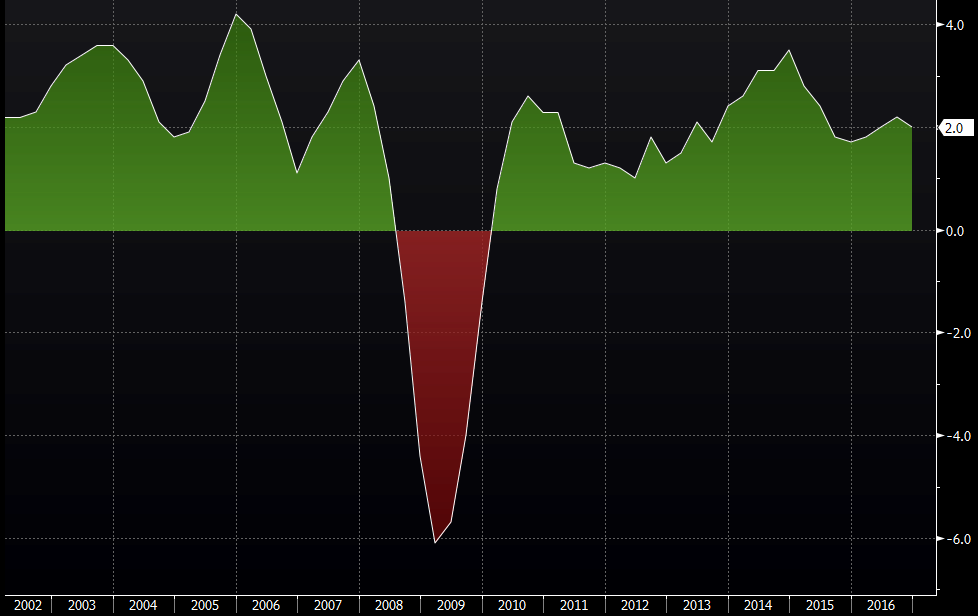

UK GDP y/y