The dollar suffers after expectations get blown again

Whatever your thoughts are about last Friday, what we do know for certain is that the Trump factor is waning in the market.

Once again traders were hoping for some big bullish comments from the Trumpster and they didn't get them. That's started the buck on another slippery slope south and that's been grasped by both the euro and pound, the latter of which is now up over 200 pips from Friday's lows.

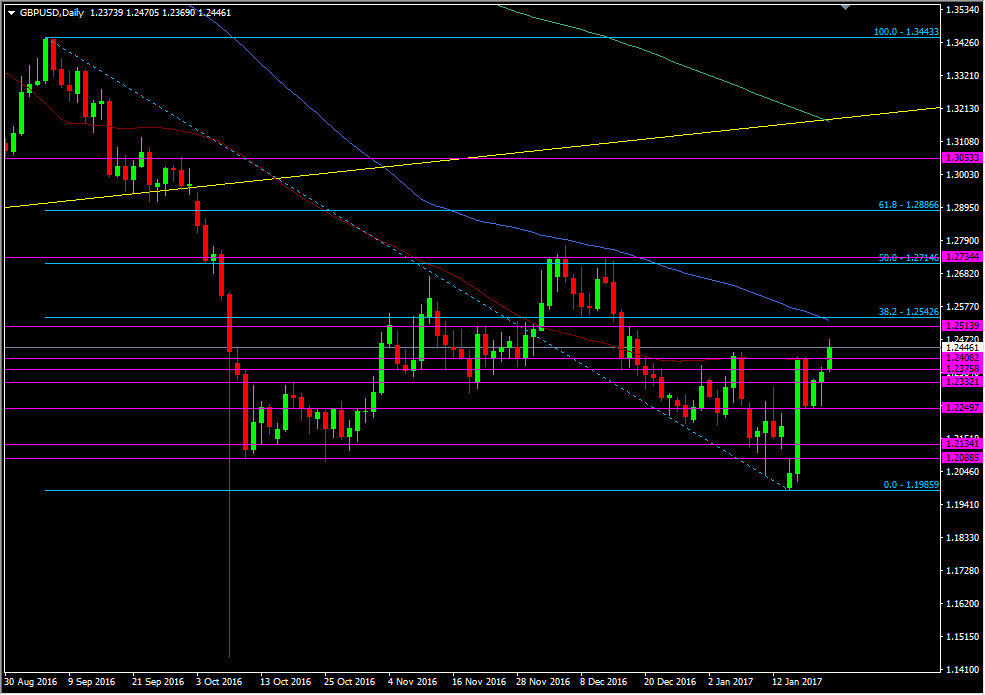

Cable knocked through the 1.2400 level, the early Jan highs and the 55 dma to a high of 1.2472.

GBPUSD daily chart

We should expect more resistance around 1.2485/90 but we have a decent amount of tech between the big figure and 1.2543.

We've build good looking support around 1.2440 and at 1.2400 so holding those will be key for this rally now. Break there, and probably 1.2380 becomes a line in the sand for the rally.

GBPUSD 15m chart

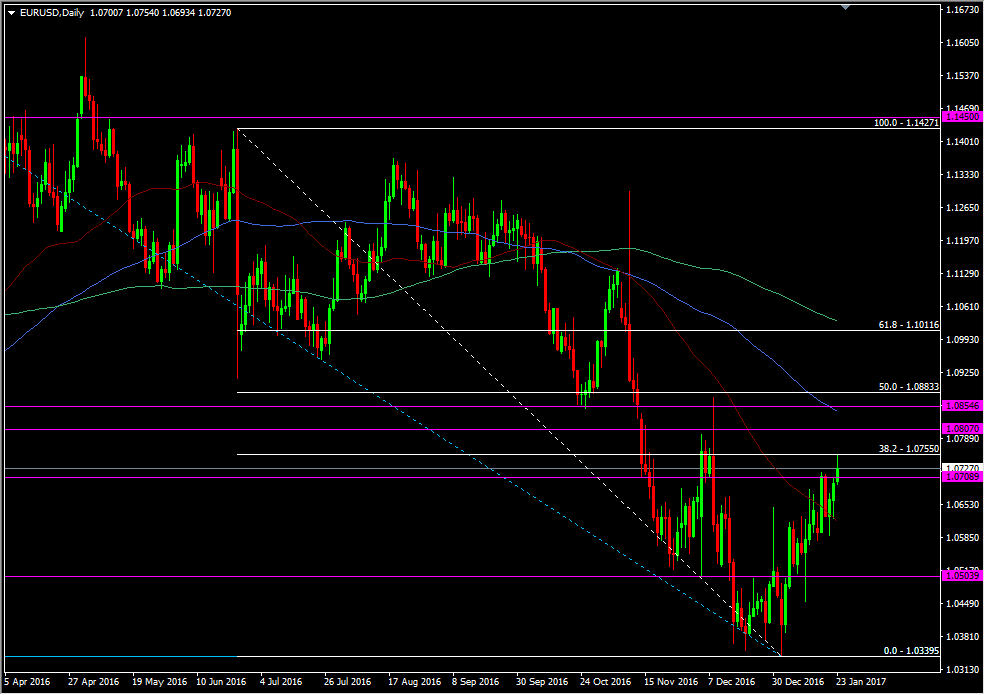

For the euro, we've made yet another new high following a dollar drop, and this time it's smacked its head right on the 38.2 fib of the Brexit vote drop at 1.0755.

EURUSD daily chart.

1.0720 is where we're seeing support and the 1.07 big figure will need to show some too. 1.0690 is maybe where the longs will cave in further if it breaks.

EURUSD 15m chart

With so much of these moves being dollar related, we should be cautious about reading too much into them. There's nothing fundamental about these moves so there's no real supportive factors behind them. A trend changing or continuing needs more than what we're getting now so we shouldn't get carried away by what we're seeing.

There's further risk factors for the pound tomorrow with the Supreme court ruling, so be on watch to see some of those nerves start to factor into the price action at some point. Mr P's going to have a bit on that in a little while.

If you're trading these moves, keep an eye on the bigger levels and how they react as they could mark a turning point intraday.