Oil prices continue drop

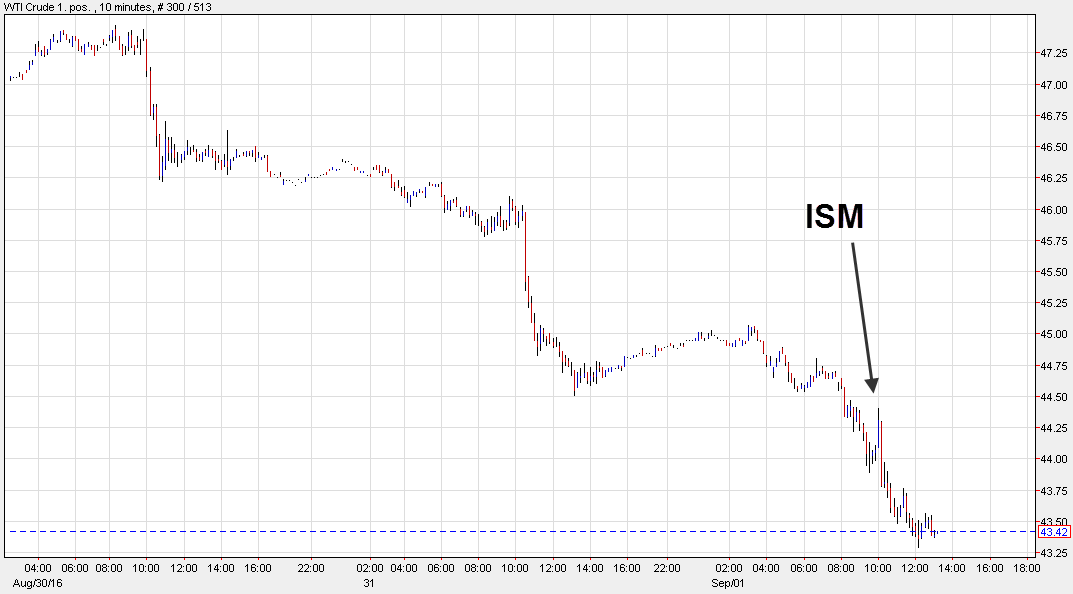

The dollar weakness after the ISM manufacturing report today was an opportunity for the bears to take profit.

They did for a moment but then were overwhelmed by waves of selling.

I wrote yesterday on why the fall in oil could continue and one reason was that September is the worst month for oil over the past 5 years and second worst over the past decade.

The September sellers are definitely stepping up so far, with today's 2.9% decline nearly matching the 10-year September average.

Another reason for declines was that there was no decent support until $43.97 but even that's given out, easily, with a low of $43.35 today. The next major level is the 61.8% retracement of the August rally and that's at $42.85.

In the overbought/sold category, the 10.5% fall in less than five days definitely raises some red flags but just before that, it rallied just as quickly so in oil, I think that's par for the course.

The risk for the bears now is that non-farm payrolls are weak. If so, that could lead to another US dollar drop.