Oil touches best level since last week in July

WTI crude oil is up 16-cents today to $43.17 after rising as high as $43.52.

The market is watching OPEC, which revealed plans yesterday to hold informal talks next month. At the same time, officials have been quick to shoot down the idea of an output freeze after the April imbroglio.

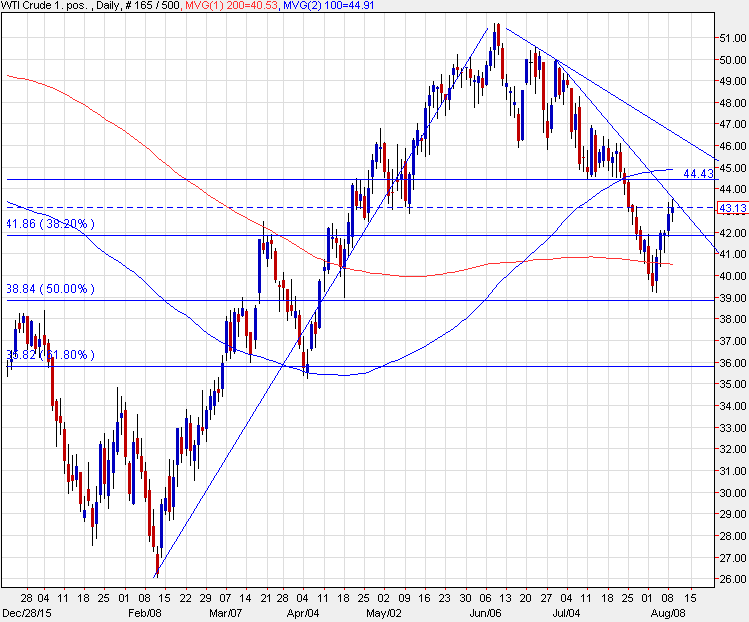

Technically, the bounce keyed off the 50% retracement of the Feb-June rally and may next challenge the July 10 low of $44.43 or the 100-day moving average at $44.91.

To me, those are appetizing levels for shorts but headline risk is high for the next 24 hours with API inventories due at the US close and EIA official supply and production numbers out at 10 am ET on Wednesday.

Some of the talk on oil surrounds large speculative oil shorts and the vulnerability of a squeeze. There is some headline risk on oil but I think the market is clued-in enough to avoid anything more than a 50-cent jump on OPEC posturing. It would have to be a big drop in US inventories or something geopolitically to drive a more sustained move.

For the oil bears, ZeroHedge has a note from Morgan Stanley's Adam Longson talking about a soft floor in WTI near $35 in the next 1-3 months. He notes that refiners aren't slowing down and that may continue to drive gluts in gasoline and distillates.

US crude oil stats are likely to trend bearish over the coming months, he writes.

"US waterborne imports are likely to stay elevated for 1-2 months given sailing times and prior price signals. However, Canadian supply is returning and refinery demand should fall seasonally (we are past peak runs). With the market trading much more closely on weekly DOE developments, a larger build in US crude oil stocks in Aug or Sep could weigh on sentiment, and WTI time spreads at a minimum."