Latest note from Barclays says that if stock falls continue USDJPY is heading south

This week, fluctuations in global risk sentiment will likely remain the main driver of JPY, says Barclays Capital

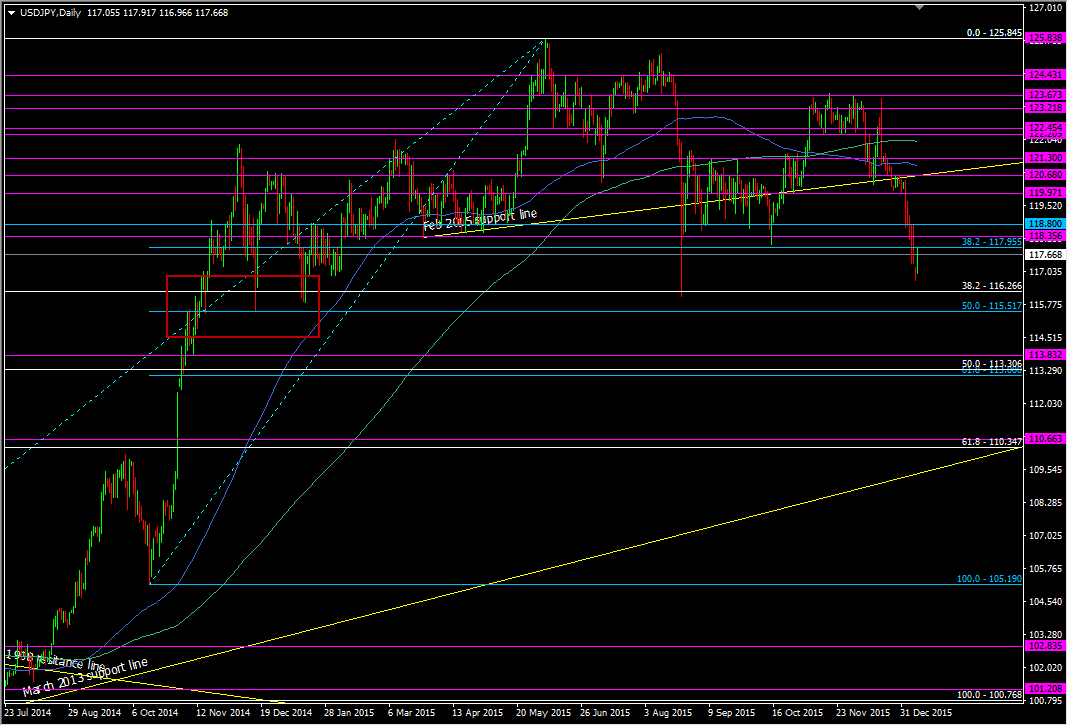

"Further weakness in global equity markets may drive USDJPY lower to test 115, the resistance level held since the BoJ delivered QQE2 in October 2014"

The 115.50 level is looking good as a support level. It's the 50.0 fib of the Oct 2014 swing up and was a resistance point at the start of that run, and then support a couple of months later. The area around 115.80 down to around 115.40 looks good technically

USDJPY daily chart

The latest CFTC futures specs positions also showed the dip into yen longs since Oct 2012 and is a further sign of the Fed trade being closed out, as well as a change in risk sentiment

For the full Barclays note and more latest news from the big banks have a look at Efx News