Yellen outlines what the Fed could do when the next recession or crisis hits

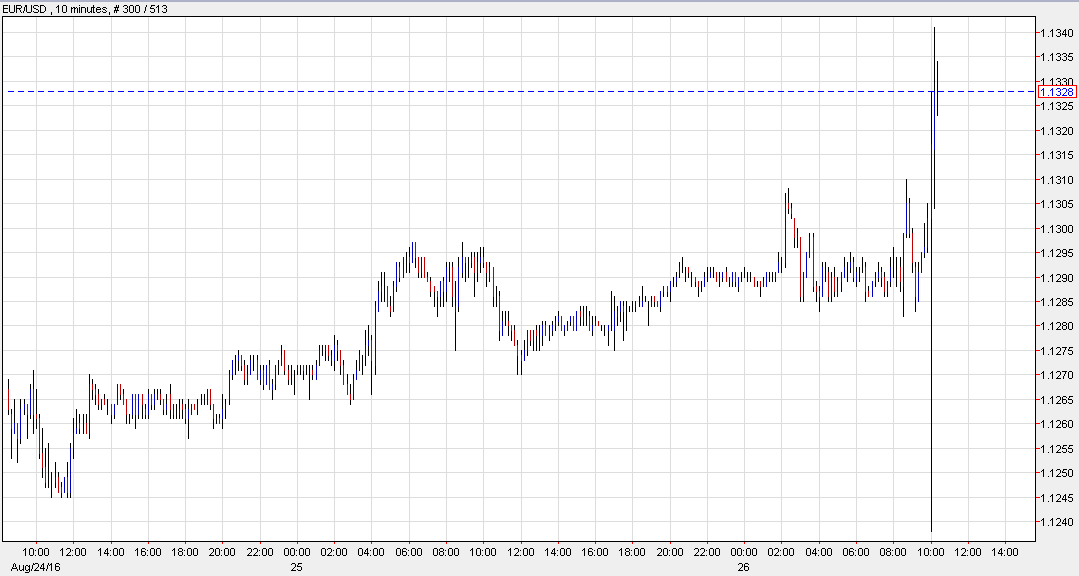

The US dollar has come under heavy pressure after an initial jump on Yellen's speech.

The Fed Chairman largely focuses on the toolkit the Fed has to deploy if trouble comes but she refrained from sending the clear signal on September that some were hoping for. The Fed funds market was pricing in a 30% chance of a hike next month but without a signal here, that chance should decline.

"I believe the case for an increase in the federal funds rate has strengthened in recent months," she said but surrounded that comment by caveats and a focus on gradual hikes, data dependence and patience.

What's also weighing on the dollar is her focus on future crisis or recession measures.

"In addition to taking the federal funds rate back down to nearly zero, the FOMC could resume asset purchases and announce its intention to keep the federal funds rate at this level until conditions had improved markedly," she said.

In addition, she looks at some of the tools that might be added to the toolkit.

"Future policymakers may wish to explore the possibility of purchasing a broader range of assets," she said, in a comment that's grabbed attention.

Yellen also touched on the possibility of changing its inflation target while stressing that none of those things are under active consideration.

Takeaways

Overall, there really isn't much here to chew on.

The conclusion expresses some confidence in the Fed and says more tools are available.

"New policy tools, which helped the Federal Reserve respond to the financial crisis and Great Recession, are likely to remain useful in dealing with future downturns. Additional tools may be needed and will be the subject of research and debate. But even if average interest rates remain lower than in the past, I believe that monetary policy will, under most conditions, be able to respond effectively," she said.

The market has done a 180-degree turn on the US dollar. The hawkish headline has been cast aside for some of this focus on longer-term options. But taking it all in, there isn't much of a signal here.

If you were looking for a clear tip of the hat towards a Sept hike, it's not here but December is still close to the 50/50 chance it was before. So dollar selling is the right reaction but I think it will be limited.