eFX with a piece from NAB on USD/JPY:

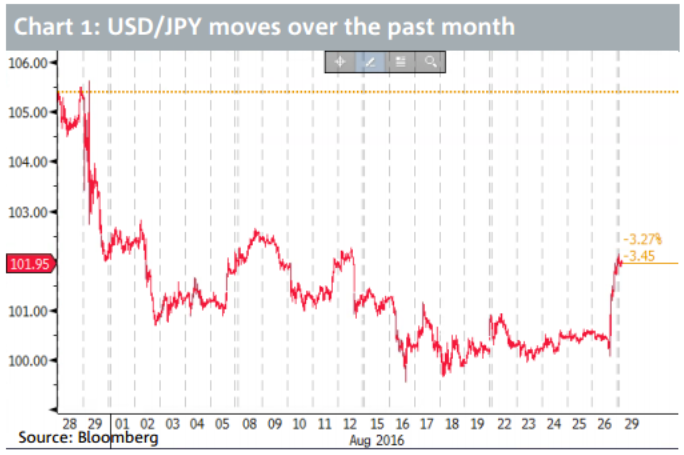

The lack of an aggressive enhancement in easing measures from the BoJ at its 29 July policy meeting dragged USD/JPY from a ¥105 handle to ¥100.68 over the course of four days. Since then and until Yellen's Jackson Hole's speech on Friday, USD/JPY was mostly contained within a ¥100-¥102 range with price action suggesting a sustained move sub- ¥100 was on the cards. Late on Friday Yellen left the door open for a September hike while still remaining non-committal and data dependent. Reaction to her speech and follow-up remarks from Vice Chair Fisher boosted the big dollar and helped USD/JPY briefly trade above ¥102 this morning (see chart 1).

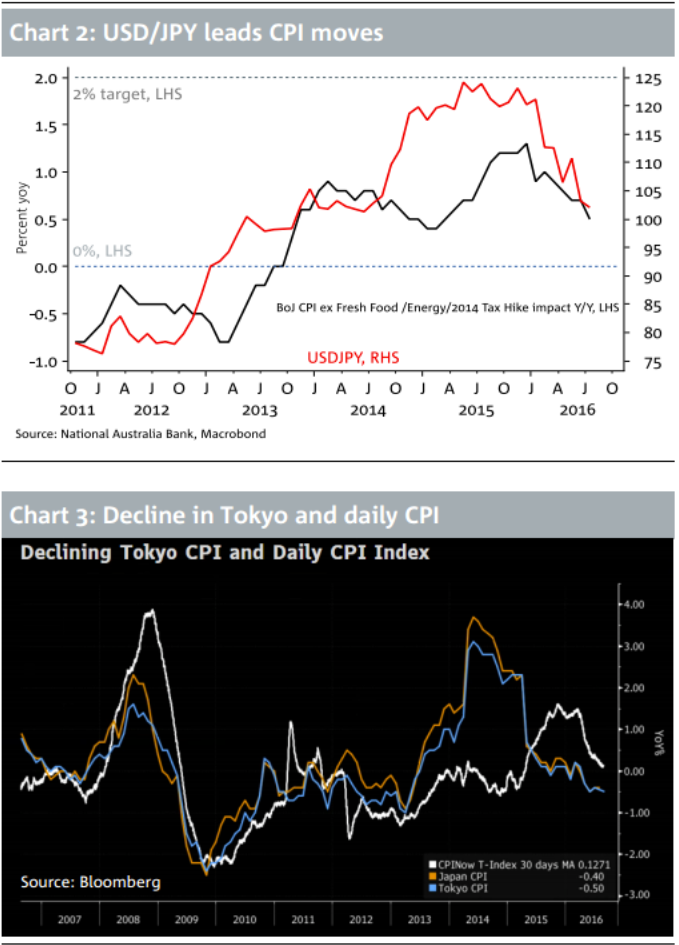

So thanks to Yellen the threat of a sustained move sub ¥100 doesn't look as ominous as it did last week. That said we maintain our view that for USD/JPY to end the year somewhere in the region of ¥105 or higher, in addition to USD appreciation a softer Yen still needs a step up in policy easing by the BoJ. Last week's CPI data confirmed our suspicion that Japan deflationary forces are gathering momentum. In July, inflation fell for a fifth month in a row with the core CPI reading, which excludes fresh food, falling to -0.5%yoy (-0.4% was expected) while the BoJ's own measure which excludes energy and fresh food fell to 0.5% from 0.7%. The lag effects from the near 20% Yen appreciation this year (chart 2) as well as the decline in the Tokyo CPI and CPINow daily inflation Index (chart 3) suggest further weakness in consumer prices should be expected in August. Kuroda has previously stated that the BoJ will act if the price target is in danger. Therefore given the latest CPI data it's hard to conceive the BoJ will not ease again in September. Nothing short of a bold and innovative BoJ will be required if USD/JPY is to appreciate on a sustained basis. Otherwise the gravitational forces from Japan's current account surplus and income payments from offshore savings are likely to overwhelm the expected mild USD appreciation from a Fed that, whatever the immediate policy outlook, is on a slow and relatively flat hiking path.

Our simple USD/JPY regression is a reminder that ultimately the fate of USD/JPY is highly dependent on the outlook for Japanese equities and US Treasury yields. We maintain our view that the Fed will only hike once in 2016 (most likely December) and that 10y UST yields will struggle to break above 1.75% this year. This gradual rise in yields assumes a still benign outcome for risk assets, but if the BoJ is to convince the market that it hasn't lost its battle against deflation, further easing will have to have an equity friendly slant. Otherwise, USD/JPY will struggle to end the year above ¥100.

Until the BoJ shows its hand, trading strategies in USD/JPY and yen crosses will need to be purely tactical.