Morgan Stanley notes technical reversals

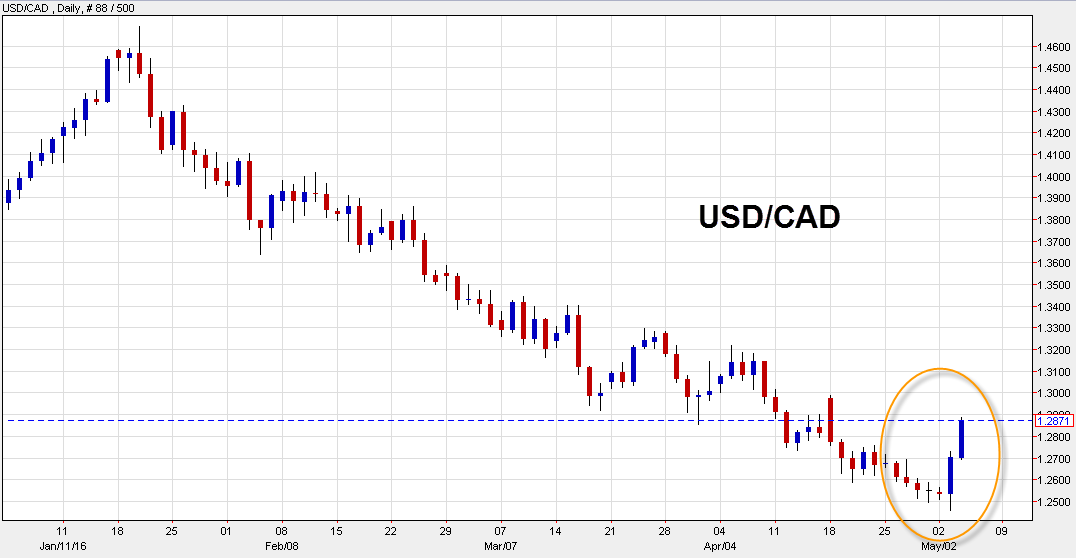

USD has developed a key reversal formation, a technical signal suggesting a near-term trend change and USD strength for now. Yesterday morning we warned that the USD decline had entered an unsustainable period by concentrating on low-yielding currencies such as JPY,EUR and CHF pushing global risk appetite lower. Markets started to raise the question concerning the cost of USD weakness carried by currency areas where policy tools to weaken local currencies looked exhausted.

Here, Japan is the most exposed with its deposit-funded banking sector reversing the impact of negative interest rates, turning them into a destructive tool. Switzerland has seen a sharp decline in its money supply expansion and a rise of mortgage rates since the introduction of negative rates.Similar effects have started to emerge in Germany, where bank liabilities are deposit-focused too, thus reducing the cost elasticity of bank balance sheets. Interestingly the EU Commission has revised its inflation forecasts drastically lower

....We suggest being long USD against commodity and EM currencies and will look to close any of our long risk positions in our portfolio.

For bank trade ideas, check out eFX Plus.